12 Top Risk Management Software Platforms for 2025

Discover the 12 top risk management software platforms for 2025. In-depth reviews comparing features, pros, cons, and pricing to help you choose.

- Home

- Compliance HubHub

- 12 Top Risk Management Software Platforms for 2025

In today's fast-paced business environment, managing risk is no longer just a defensive strategy-it's a critical component for gaining a competitive advantage. Organizations are constantly navigating a complex web of potential challenges, including evolving cybersecurity threats, stringent regulatory changes, and unexpected operational hurdles. The right software transforms risk management from a reactive, spreadsheet-driven chore into a proactive, data-informed function that drives strategic decisions.

This guide cuts through the marketing noise to provide an in-depth, practical analysis of the top risk management software solutions available in 2025. We move beyond generic feature lists to give you a clear, honest assessment of each platform's strengths, weaknesses, and ideal use cases. You'll find direct comparisons, screenshots, and links to help you evaluate everything from AI-powered compliance automation tools for startups seeking fast SOC 2 certification to comprehensive enterprise suites like ServiceNow and Archer.

Our goal is to provide a clear roadmap to help you identify the platform that best aligns with your organization's specific needs, scale, and strategic goals. To truly leverage these powerful tools, it's essential to first understand core principles like effective project risk management strategies . This foundational knowledge ensures you select a solution that not only protects your business but also primes it for sustainable growth. Whether you're a mid-market SaaS company needing automated compliance or a healthcare organization requiring HIPAA readiness, this list will help you make a confident, well-informed decision.

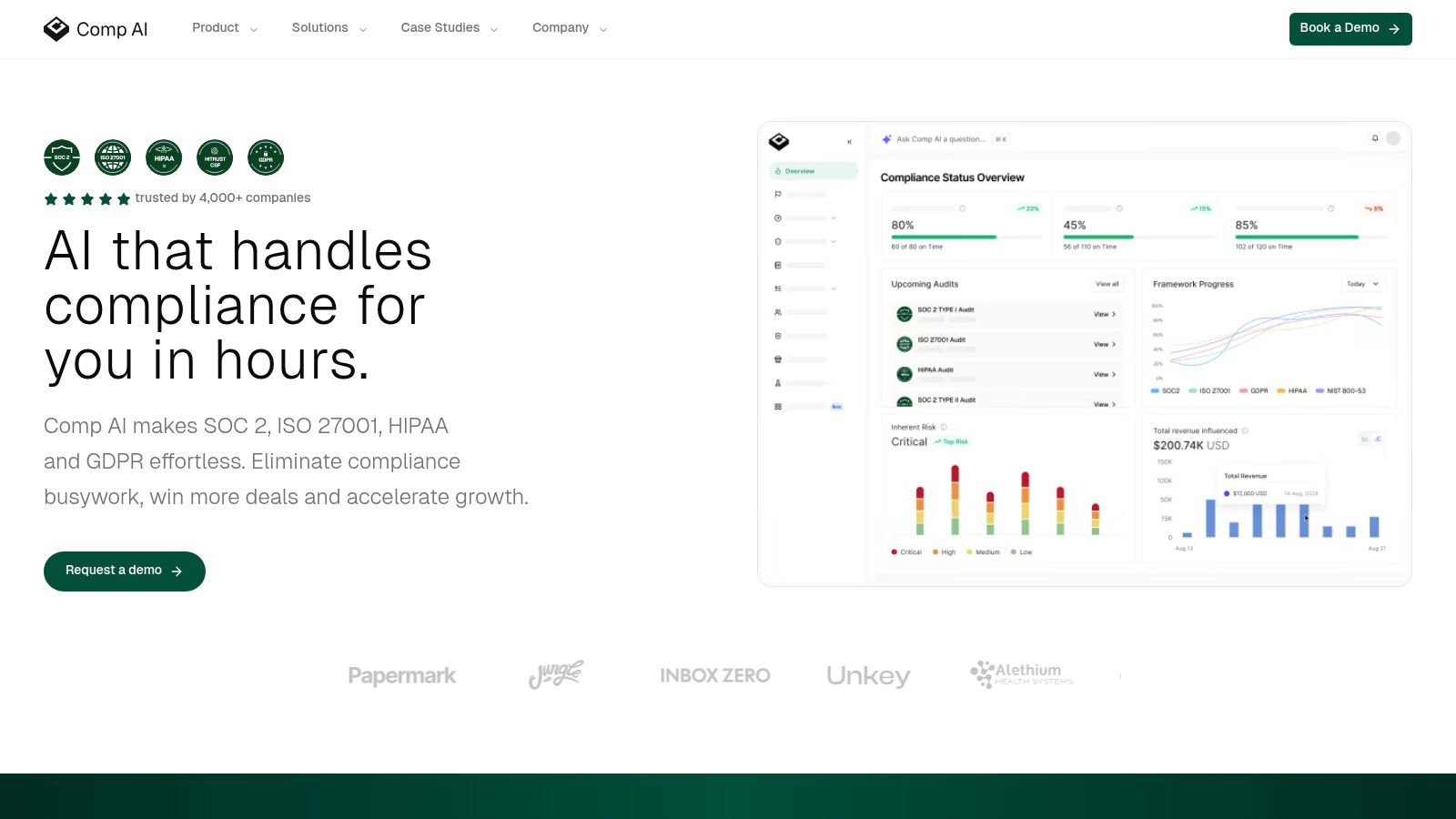

1. Comp AI: Best for AI-Powered Compliance Automation & Speed

Comp AI is a transformative, AI-first platform designed for modern tech companies that require rapid, verifiable compliance. It’s an exceptional choice for startups and mid-market organizations that view security frameworks not just as a regulatory hurdle, but as a competitive advantage. The platform's core strength lies in its ability to condense audit preparation timelines from months into mere days, or even hours, making it a standout solution in the top risk management software category.

By leveraging autonomous AI agents, Comp AI moves beyond simple checklists. These agents integrate directly with over 100 cloud services, development tools, and HR platforms like AWS, GitHub, and Google Workspace. This direct integration automates the most time-consuming aspects of compliance, such as evidence collection, control documentation, and continuous monitoring, ensuring your organization is perpetually audit-ready.

Comprehensive Feature Analysis

Comp AI offers a cohesive suite of tools that centralize the entire risk and compliance lifecycle:

- Autonomous AI Agents: The platform's most powerful feature. These agents act as a virtual compliance team, performing tasks 24/7. For example, an agent can automatically take a screenshot of a specific AWS security group configuration, document that it aligns with a SOC 2 control, and flag any deviations in real-time.

- All-in-One Compliance Hub: This centralized dashboard eliminates the need for scattered spreadsheets and documents. It provides a single source of truth for all controls, policies, evidence artifacts, and auditor communications, greatly simplifying audit management.

- Continuous Risk Intelligence: The system proactively researches vendor security postures, automatically updates internal policies to reflect new threats, and quantifies risks across more than 25 compliance frameworks. It suggests concrete mitigation steps, moving teams from a reactive to a proactive security stance.

- AI-Powered Trust Center: A significant value-add for sales teams, this feature automates security questionnaire responses and creates a public-facing, real-time security portal hosted on your domain.

Practical Use Cases & Implementation

For a B2B SaaS startup needing a SOC 2 report to close an enterprise deal, Comp AI is a game-changer. The platform can achieve SOC 2 Type I readiness in as little as 24 hours. The white-glove onboarding process, which includes 1:1 Slack support and custom policy generation, ensures a smooth and guided implementation. The team also connects you with pre-vetted auditors, streamlining the entire process from start to finish. This hands-on support is a key differentiator, as noted in the announcement of their successful pre-seed funding round .

Pricing and Support

Comp AI utilizes a custom pricing model, requiring a consultation to tailor a plan to your specific needs. While this lacks the transparency of tiered pricing, it ensures you pay only for what you need. Their high-touch support model is a major advantage, providing direct access to compliance experts via a dedicated Slack channel. This approach, combined with a 100% audit success rate and a money-back guarantee, makes it a risk-free and highly effective investment.

| Feature Highlight | Key Benefit |

|---|---|

| Audit Speed | Achieve SOC 2 in 24 hours, HIPAA in 7 days |

| Automation Level | Fully autonomous evidence collection and continuous monitoring |

| Support Model | Dedicated 1:1 Slack channel and expert guidance |

| Financial Guarantee | 100% audit success rate with a money-back guarantee |

Pros:

- Drastically accelerates compliance timelines for major frameworks

- Reduces manual workload through deep AI-driven automation

- Exceptional, high-touch customer support via dedicated Slack access

- Risk-free investment with a 100% audit success guarantee

Cons:

- Custom pricing requires a demo, which can slow down initial evaluation

- Best suited for startups and mid-market firms; may require customization for complex enterprise environments

Website: https://trycomp.ai

2. G2 – Risk Management Software category

G2 is not a risk management tool itself but an essential starting point for your research. It’s one of the largest software marketplaces, providing an exhaustive, real-time look at the landscape of top risk management software. The platform aggregates verified user reviews, allowing you to filter and compare dozens of solutions side-by-side based on company size, industry, and specific features. This makes it an invaluable resource for quickly creating a shortlist of vendors that align with your specific needs.

What sets G2 apart is its proprietary "Grid" system, which visually maps out market leaders, contenders, and niche players based on user satisfaction and market presence. This provides an immediate, data-driven overview that is far more efficient than visiting individual vendor websites. You can dive deep into sub-categories like Enterprise Risk Management (ERM), Third-Party Risk Management (TPRM), and IT Risk Management to find specialized tools.

Key Features & Considerations

- Review Volume: G2 features a massive, recency-weighted volume of user reviews, ensuring feedback is current and relevant.

- Strategic Filtering: You can filter tools by specific features, deployment type, company size, and user ratings to narrow down options quickly.

- Direct Access: The platform provides direct links to vendor websites, free trials, and demo requests, streamlining the next steps in your evaluation process.

Pro Tip: Pay close attention to the review dates. A recent surge in negative or positive reviews can indicate a significant change in product quality or customer support.

| Pros | Cons |

|---|---|

| Large base of US-centric reviews offers relevant peer feedback. | Sponsored placements can affect vendor visibility in lists. |

| Compare competing platforms easily with the "Grid" and filter system. | Pricing information is often hidden and requires visiting the vendor's site. |

| In-depth reviews cover implementation, support, and usability. | Reviews may lack context for highly specialized or niche use cases. |

3. Capterra – Risk Management Software directory

Capterra, a Gartner-owned company, serves as another essential software directory for anyone researching top risk management software. Its interface is particularly beginner-friendly, offering detailed buyer guides and clear explanations of different software categories. The platform allows users to browse, filter, and compare a wide range of risk management solutions, making it an excellent resource for creating an initial vendor shortlist.

What makes Capterra stand out is its transparency around pricing and features. Many listings include pricing guidance ranges and highly detailed feature checklists, which can save significant time during the initial evaluation phase. The directory also maintains a separate, dedicated section for Integrated Risk Management (IRM) tools, helping businesses find solutions that align with a more holistic governance, risk, and compliance (GRC) strategy.

Key Features & Considerations

- Pricing Guidance: Capterra often provides estimated pricing ranges, offering a preliminary look at potential budget requirements before visiting a vendor's site.

- Feature Checklists: Detailed checklists allow for granular, side-by-side comparisons of specific functionalities offered by different platforms.

- Strategic Sorting: Users can sort listings by "Highest Rated" or "Most Reviews" and apply robust filters for deployment models (cloud, on-premise) or free trial availability.

Pro Tip: Use Capterra's buyer guides to understand the core features you should be looking for. This will help you filter more effectively and move beyond relying solely on overall star ratings.

| Pros | Cons |

|---|---|

| Beginner-friendly guides and well-defined category explanations. | Sponsored pay-per-click listings can influence the order of vendors. |

| Highlights free and free-trial options, ideal for initial testing. | Users must validate vendor fit beyond star ratings for their specific needs. |

| Clear details on deployment models (cloud, on-premise, etc.). | Some niche software solutions may have a limited number of reviews. |

4. AWS Marketplace – Risk & security risk products

AWS Marketplace is an enterprise procurement platform rather than a singular risk tool, but its role in the modern IT and security stack makes it a critical resource. It serves as a digital catalog where organizations can find, buy, deploy, and manage third-party software, including a growing selection of top risk management software. The platform is deeply integrated into the AWS ecosystem, allowing for consolidated billing and streamlined purchasing directly through existing AWS agreements, which significantly simplifies budgeting and vendor management.

What makes AWS Marketplace stand out is its "Vendor Insights" feature, which helps security teams accelerate due diligence. This dashboard provides a unified view of a vendor's security and compliance posture, compiling information across 125+ controls into a single, accessible location. This dramatically reduces the time and effort required for vendor risk assessments, shortening legal and procurement cycles from months to weeks. It is an ideal starting point for companies already invested in the AWS cloud looking to procure specialized risk tools like TPRM or EASM solutions.

Key Features & Considerations

- Vendor Insights: Access a dashboard with over 125 security and compliance controls to streamline third-party risk assessments.

- Consolidated Billing: Purchases are added to your existing AWS bill, simplifying procurement and financial tracking.

- Flexible Procurement: The platform supports transparent pricing, free trials, and private offers for many risk-related SaaS products.

Pro Tip: Use the Vendor Insights dashboard to create a shortlist of pre-vetted vendors. This can significantly reduce the internal effort required from your information security and legal teams during the procurement process.

| Pros | Cons |

|---|---|

| Drastically reduces legal and procurement cycle time for new tools. | Not all leading GRC or ERM suites are available on the platform yet. |

| Private offers and consolidated billing simplify budgeting and payment. | Some software listings lack native AWS customer reviews for social proof. |

| Streamlines infosec reviews with standardized compliance data. | Best suited for organizations already operating within the AWS ecosystem. |

5. Salesforce AppExchange – Risk/GRC ecosystem

For organizations deeply embedded in the Salesforce ecosystem, the AppExchange is a powerful resource for finding top risk management software that integrates seamlessly with existing CRM data and workflows. It's not a single tool but a marketplace featuring a wide range of Salesforce-native risk, governance, and compliance (GRC) applications from various vendors. Solutions like Fusion Risk Management and others leverage your existing Salesforce infrastructure, which can dramatically shorten deployment times and improve user adoption.

The primary advantage of the AppExchange is its rigorous vetting process. Every app listed has passed a Salesforce security review, providing a baseline of trust and compliance. This integrated approach allows risk management to become a natural extension of your sales, service, and marketing operations, connecting risk data directly to customer accounts, contracts, and partner records for a holistic view.

Key Features & Considerations

- Salesforce Security Review: All listed applications are pre-vetted by Salesforce, ensuring a high standard of security and data privacy.

- Rapid Evaluation: Many apps offer "Test Drive" environments or free trials, allowing for quick, hands-on evaluation without a lengthy sales process.

- Native Integration: Tools are built on the Salesforce platform, enabling deep integration with your existing data, workflows, and user authentication systems.

- Diverse Solutions: The ecosystem covers a broad spectrum of risk domains, including Business Continuity Management (BCM), Third-Party Risk Management (TPRM), and operational resilience.

Pro Tip: Use the filters to search for apps with the highest ratings and most recent reviews. Pay close attention to the "Highlights" section on each listing, which details key features and required Salesforce editions.

| Pros | Cons |

|---|---|

| Accelerates pilot projects for teams already using Salesforce. | Best suited for organizations already invested in the Salesforce platform. |

| Broad ecosystem covering multiple risk domains in one marketplace. | Subscription costs can accumulate based on user counts and apps. |

| Single sign-on and familiar UI can lead to faster user adoption. | Some partner listings require contacting sales for pricing details. |

6. Archer (formerly RSA Archer) – Integrated Risk Management

Archer is a long-established and highly regarded Integrated Risk Management (IRM) platform, known for its comprehensive and modular approach. It provides a unified framework for managing various risk domains, including enterprise, operational, IT, security, and third-party risk. As one of the top risk management software choices for large enterprises, Archer’s strength lies in its ability to centralize disparate risk and compliance activities into a single, cohesive system. This allows organizations to break down silos and gain a holistic view of their risk posture.

The platform is built on a unified data model, which enables standardized taxonomies and workflows across the entire organization. This is particularly valuable for complex businesses that need to align risk management with strategic objectives. Archer offers both SaaS and on-premises deployment options, providing the flexibility required by organizations with specific security or infrastructure requirements. Its deep functionality supports everything from risk assessment and issue tracking to business continuity and audit management.

Key Features & Considerations

- Modular Solutions: Archer allows you to license specific use cases like TPRM or Business Resiliency and add more as your program matures.

- High Configurability: The platform’s workflows, reporting, and dashboards are highly customizable to fit unique business processes and regulatory needs.

- Deployment Flexibility: Offers both cloud-based SaaS and on-premises deployments to accommodate diverse IT strategies and data residency rules.

Pro Tip: Due to its complexity, successful implementation often requires dedicated internal resources or a third-party implementation partner. Plan for significant configuration and training to maximize your ROI.

| Pros | Cons |

|---|---|

| Mature and proven platform with broad enterprise adoption. | Generally priced at enterprise levels with quote-based pricing only. |

| Extensive depth in risk, audit, and resilience use cases. | Requires significant implementation effort and configuration. |

| Unified data model creates a single source of truth for risk. | The user interface can feel dated compared to newer, cloud-native tools. |

7. Riskonnect – Enterprise Risk, TPRM, RMIS, Operational Risk

Riskonnect offers a cloud-based GRC and ERM platform that uniquely bridges the gap between traditional enterprise risk, compliance, and insurance-related risk management. It is designed for organizations looking to consolidate disparate risk functions into a single source of truth, supporting everything from operational risk and internal controls to claims administration and ESG reporting. This integrated approach allows data to flow seamlessly between risk, compliance, and insurance teams.

What sets Riskonnect apart is its powerful combination of ERM, GRC, and a built-in Risk Management Information System (RMIS). While many tools focus solely on operational or IT risk, Riskonnect brings claims, policies, and insurance data into the broader risk conversation. This makes it one of the top risk management software choices for companies with significant insurance programs or complex claims management needs that must align with their enterprise risk posture.

Key Features & Considerations

- Unified Risk View: Centralized risk registers integrate KRIs, KPIs, heat maps, and dashboards for a holistic view of enterprise and operational risks.

- RMIS and Claims: Includes robust RMIS and claims administration capabilities, a key differentiator for managing insurance-related aspects of risk.

- Modular Add-Ons: The platform is extensible with modules for specific needs like internal controls (SOX), ESG disclosure management, and third-party risk management .

Pro Tip: Evaluate which modules are essential from the start. Riskonnect's strength is its breadth, but implementing too many modules at once can complicate the initial setup and user adoption.

| Pros | Cons |

|---|---|

| Comprehensive suite covers ERM, GRC, and RMIS under one vendor. | An enterprise sales approach means custom pricing and no public tiers. |

| Strong data-sharing capabilities across risk and compliance teams. | The scope of deployment can increase implementation and configuration time. |

| Connects insurance and claims data directly to enterprise risk profiles. | May be too feature-rich for smaller organizations with simple risk needs. |

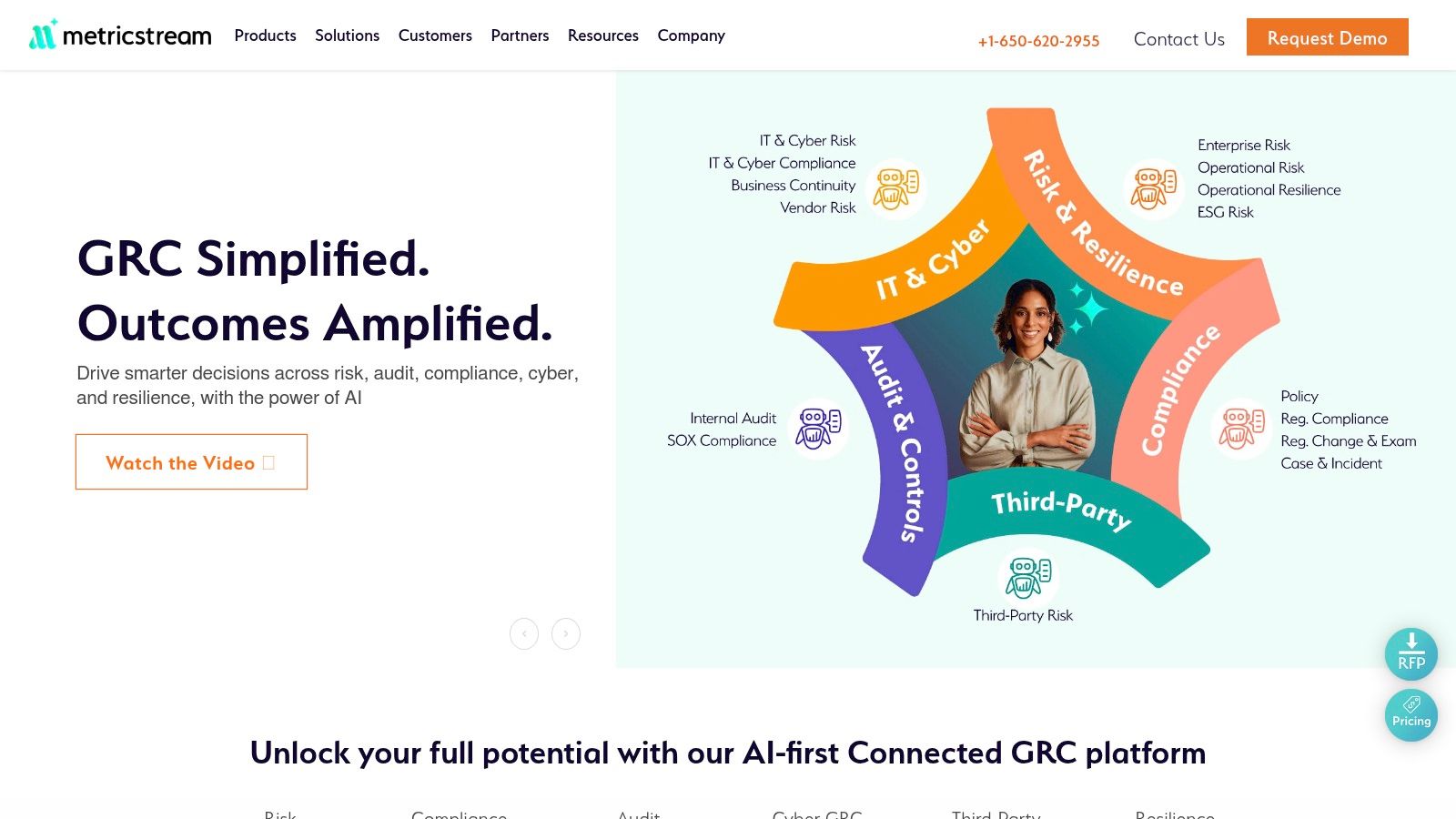

8. MetricStream – Connected GRC / Integrated risk Platform

MetricStream is an AI-first Governance, Risk, and Compliance (GRC) platform designed for large, complex organizations seeking a unified view of risk. It stands out by connecting disparate risk functions like enterprise risk, cyber GRC, third-party risk, compliance, and internal audit into a single, integrated framework. This approach breaks down silos and provides a holistic perspective on an organization's risk posture, making it a powerful choice for mature risk programs.

What makes MetricStream one of the top risk management software solutions is its foundation on a single, federated data model. This architecture ensures that data is consistent across all modules, enabling powerful, cross-functional analytics and reporting. The platform leverages AI to provide continuous control monitoring and predictive risk insights, helping teams move from a reactive to a proactive risk management stance. Its "AppStudio" feature also allows for significant customization, letting enterprises build bespoke applications to meet unique GRC needs.

Key Features & Considerations

- Integrated Modules: Offers comprehensive modules for ERM, operational risk, compliance, audit, cyber GRC, and third-party risk management.

- AI-Powered Insights: Utilizes artificial intelligence to automate control monitoring, identify emerging risks, and streamline compliance processes.

- AppStudio Extensibility: Provides a low-code environment for building custom GRC applications, ensuring the platform can adapt to specific business requirements.

Pro Tip: Given its complexity and deep configurability, prospective users should plan for a detailed implementation process. Engage with MetricStream's professional services or a certified partner to ensure the platform is configured to align perfectly with your organization's specific GRC frameworks and objectives.

| Pros | Cons |

|---|---|

| Highly configurable and well-suited for large, complex enterprises. | Implementation requires significant effort and specialized expertise. |

| A recognized industry leader with strong analyst ratings and a large user base. | May be overly complex and expensive for smaller or mid-sized businesses. |

| The unified data model enables powerful, cross-functional analytics. | The extensive feature set can have a steep learning curve for new users. |

9. ServiceNow – Governance, Risk, and Compliance (GRC)

ServiceNow GRC is a powerful, integrated risk management solution built on the Now Platform, making it an ideal choice for organizations already invested in the ServiceNow ecosystem for ITSM or security operations. It centralizes governance, risk, compliance, business continuity, and third-party risk management into a single data model. This unified approach leverages AI-assisted workflows to break down silos between departments, providing real-time visibility into an organization’s risk posture across the entire enterprise.

What distinguishes ServiceNow is its ability to connect risk management directly to operational data and workflows that already exist within the platform. This means a security incident logged in their SecOps module can automatically trigger a risk assessment, update control statuses, and notify relevant stakeholders without manual intervention. This deep integration makes it one of the most cohesive options for large enterprises seeking to embed risk management into daily operations, rather than treating it as a separate function.

Key Features & Considerations

- Integrated IRM: The solution combines GRC, Business Continuity Management (BCM), privacy, and Third-Party Risk Management (TPRM) on a single platform.

- Workflow Automation: It uses AI-powered insights and automation to streamline control testing, risk assessments, and Key Risk Indicator (KRI) monitoring. Learn more about how a compliance automation platform can streamline these processes.

- Unified Data Model: All risk-related activities are managed within a single system of record, which enhances reporting accuracy and decision-making.

Pro Tip: Leverage ServiceNow’s "Store" to find certified, pre-built integrations and applications that can extend GRC functionality to specific regulatory frameworks or industry needs.

| Pros | Cons |

|---|---|

| Strong fit for customers already using other ServiceNow modules. | Enterprise pricing is quote-based and typically requires partner implementation. |

| Broad product family available from a single, unified vendor. | Best ROI is achieved when other ServiceNow modules exist in the IT stack. |

| Highly customizable workflows to match specific business processes. | Can be complex to configure without specialized expertise. |

10. AuditBoard – Connected Risk (ERM/ORM, SOX, TPRM, Compliance)

AuditBoard positions itself as a modern, connected risk platform with deep roots in the audit community, making it one of the top risk management software choices for teams prioritizing usability. The platform is designed by former auditors and risk practitioners, which is reflected in its intuitive user experience and workflows that resonate with its target audience. It provides a unified view of risk by connecting data from SOX compliance, internal controls, enterprise risk management (ERM), and third-party risk management (TPRM) into a single source of truth.

What sets AuditBoard apart is its "audit-led" approach to GRC, ensuring that internal audit, SOX, and compliance functions are tightly integrated with broader risk management activities. This helps break down traditional silos between departments. When exploring different software options, it's helpful to use marketplaces that provide feature checklists and pricing guidance. You can also see which solutions are recognized as Capterra's emerging favorites and category leaders to gauge market sentiment and user satisfaction across various software sectors.

Key Features & Considerations

- Practitioner-Focused UX: The platform is consistently praised for its ease of use, which helps drive faster adoption across risk, audit, and compliance teams.

- Integrated Modules: AuditBoard offers modules covering ERM, SOX, internal controls, TPRM, and compliance that are designed to work together seamlessly.

- Content and AI: It integrates with content libraries like Protiviti KnowledgeLeader and includes AI features to help automate and streamline risk assessment and control testing. For those focused on the audit side, you can explore other top-rated audit management software for comparison.

Pro Tip: Leverage AuditBoard's templates and integrations during implementation to accelerate your program's setup and reduce the initial administrative burden.

| Pros | Cons |

|---|---|

| Reported fast adoption and an excellent user experience. | Enterprise pricing with limited publicly available information. |

| Strong capabilities in audit and SOX compliance. | Advanced use cases may require partner or professional services support. |

| Connects multiple GRC functions in a single, unified platform. | May have more features than necessary for very small risk teams. |

11. OneTrust – Tech Risk & Compliance / GRC

OneTrust has established itself as a leader in the governance, risk, and compliance (GRC) space, with a strong foundation in privacy and data protection. It offers a comprehensive suite of tools designed to automate and manage IT/security risk, third-party risk management (TPRM), and compliance with an ever-growing list of regulations. This platform is particularly effective for enterprises and higher education institutions that need to centralize their risk and compliance functions.

What makes OneTrust a standout option in the top risk management software landscape is its powerful automation engine and content library. The platform supports over 40 regulatory frameworks, automating assessments, policy management, and control mapping. This significantly reduces the manual effort required to maintain compliance with standards like GDPR, CCPA, and HIPAA, allowing teams to focus on strategic risk mitigation rather than administrative tasks.

Key Features & Considerations

- Broad Framework Support: Automates governance and compliance activities across more than 40 industry and regulatory frameworks.

- Modular Architecture: Includes dedicated modules for IT & Security Risk, TPRM, Business Continuity Management (BCM), and audit management.

- Enterprise-Grade Security: Built on a multi-tenant SaaS architecture with enterprise SSO and granular, role-based access controls to protect sensitive data.

Pro Tip: Start by mapping your most critical regulatory requirements. OneTrust's modular pricing means you can purchase only the frameworks and capabilities you need initially, adding more as your program matures.

| Pros | Cons |

|---|---|

| Large and active customer base drives continuous product development. | The user interface can feel complex and overwhelming for smaller teams. |

| Strong automation capabilities for TPRM and compliance workflows. | Pricing varies significantly based on modules and user count. |

| Excellent heritage in privacy and compliance content automation. | Implementation may require dedicated resources to configure properly. |

12. Fusion Risk Management – Enterprise Resilience & Risk (Salesforce-native)

Fusion Risk Management is a resilience-led platform that tightly integrates risk management with business continuity and operational resilience. Built natively on the Salesforce platform, it is uniquely positioned for organizations already invested in the Salesforce ecosystem. The software allows teams to manage crises, plan for business continuity, and assess supplier risk within the familiar Salesforce Lightning interface, leveraging existing CRM data to contextualize threats and responses.

What sets Fusion apart is its deep integration with Salesforce products like Work.com and AppExchange. This enables powerful, interconnected workflows for managing everything from workforce resilience and return-to-work planning to comprehensive supplier due diligence. By unifying these functions on a single platform, it breaks down silos between risk, continuity, and operations teams, creating a more holistic view of organizational resilience. This makes it a standout choice among the top risk management software for Salesforce-centric enterprises.

Key Features & Considerations

- Salesforce Foundation: Leverages the scalability and familiarity of the Salesforce Lightning platform, enabling native CRM data utilization and customization.

- Unified Resilience: Combines business continuity management (BCM), crisis management, and supplier risk into a single, cohesive system.

- Ecosystem Integration: Connects with Salesforce AppExchange and Work.com products to extend functionality for workforce and operational resilience.

Pro Tip: Fully leverage the platform’s capabilities by mapping your business processes and critical dependencies within Fusion. This will provide actionable insights during a disruption and streamline incident response directly from your Salesforce dashboard.

| Pros | Cons |

|---|---|

| Excellent choice for organizations prioritizing resilience with risk context. | Best suited for organizations already leveraging the Salesforce platform. |

| Familiar user interface for Salesforce users enables fast adoption. | Enterprise-level pricing and deployment complexity require admin expertise. |

| Connects risk management directly to operational and supplier data. | May be overly complex for smaller businesses not needing deep BCM. |

Top 12 Risk Management Software Comparison

| Platform | Core Features | User Experience / Quality Metrics | Value Proposition | Target Audience | Price Points / Pricing Model |

|---|---|---|---|---|---|

| Comp AI | AI-driven automation, centralized compliance hub, continuous risk intelligence | Fast compliance readiness (SOC 2 in 24h), 1:1 Slack support, white-glove onboarding | Rapid audit readiness, reduces busywork, money-back guarantee | Startups, scale-ups, mid-market | Not publicly disclosed, competitive for speed & features |

| G2 – Risk Management Software | Verified user reviews, category grids, trial links | Large, recent review volume, easy platform comparison | Quick shortlist and vendor sentiment insights | Risk software buyers | Free to use; vendor pricing varies |

| Capterra – Risk Management | Feature checklists, pricing ranges, buyer guides | Beginner-friendly, well-structured category info | Clear product insights and trial info | Buyers new to risk software | Free to use; sponsorships may affect order |

| AWS Marketplace – Risk & Security | Vendor Insights dashboard, consolidated AWS billing | Streamlined procurement, transparent pricing | Simplifies vendor risk assessment and legal cycles | AWS customers and enterprises | Transparent pricing; varies by vendor |

| Salesforce AppExchange | Salesforce-certified apps, test drives, strong integration | Fast evaluation through demos, native Salesforce workflows | Rapid deployment for Salesforce users | Salesforce users & admins | Subscription-based, user/app dependent |

| Archer (RSA Archer) | Modular IRM, SaaS & on-prem, configurable dashboards | Mature platform, enterprise adoption | Broad, in-depth risk and audit coverage | Large enterprises | Quote-based, enterprise pricing |

| Riskonnect | Centralized risk registers, RMIS, ESG reporting | Covers ERM to claims management | Comprehensive risk and compliance data sharing | Enterprises, insurance | Custom pricing, enterprise focus |

| MetricStream | AI-driven analytics, federated data model, AppStudio | Leader recognition, deep configurability | Connected GRC for large enterprises | Large enterprises | Quote-based, high implementation effort |

| ServiceNow GRC | AI workflows, unified platform, third-party risk portals | Strong integration if on ServiceNow platform | End-to-end GRC with AI automation | ServiceNow customers | Quote-based, partner implementation needed |

| AuditBoard | AI-assisted content, SOX/internal controls, integrations | Practitioner-friendly, rapid adoption | Audit-led GRC with strong SOX focus | Enterprise audit teams | Enterprise pricing, limited public info |

| OneTrust | Privacy-first, 40+ frameworks, automation modules | Large user base, evolving product suite | Strong automation for TPRM and privacy compliance | US enterprises, education | Variable by modules and users |

| Fusion Risk Management | BCM, crisis management, native Salesforce platform | Familiar UI for Salesforce users | Resilience integrated with Salesforce workflows | Salesforce organizations | Enterprise pricing, deployment complexity |

Making Your Final Decision: How to Choose the Right Platform

Navigating the landscape of top risk management software can feel overwhelming. We've journeyed through enterprise-level GRC giants like Archer and ServiceNow, explored connected risk platforms from AuditBoard and OneTrust, and highlighted specialized solutions built on ecosystems like Salesforce and AWS. The key takeaway is clear: there is no single "best" platform for everyone. The right choice is deeply contextual, hinging entirely on your organization's specific needs, maturity, and strategic objectives.

The decision-making process isn't just about comparing features; it's about finding a technology partner. Your goal is to select a system that not only solves today's problems but also scales with you as your risk and compliance programs evolve.

From Theory to Practice: Actionable Next Steps

To move from evaluation to implementation, you need a structured approach. The information overload from demos and spec sheets can obscure what truly matters. We recommend a focused, internal-first methodology to ensure you select the software that delivers genuine value.

Here are the critical steps to guide your final decision:

- Define Your Primary Driver: What is the single most urgent problem you need to solve? Is it achieving SOC 2 or ISO 27001 certification under a tight deadline? Is it centralizing disparate risk registers across business units? Or is it automating the manual, spreadsheet-driven vendor risk assessment process? Your primary driver will immediately narrow the field. For instance, a startup needing fast compliance will find AI-driven automation far more valuable than a complex, on-premise IRM suite.

- Map Your Stakeholders and Resources: Who will own this platform? Identify the day-to-day users (like security analysts), the approvers (like department heads), and the executive sponsors (like the CISO or CFO). Consider their technical aptitude and the time they can realistically dedicate to the tool. Also, be honest about your internal resources. Do you have a dedicated implementation team, or do you need a "done-for-you" solution with extensive support?

- Calculate Total Cost of Ownership (TCO): Look beyond the sticker price. A comprehensive TCO analysis includes subscription fees, implementation costs, data migration expenses, training for your team, and potential fees for third-party consultants. A platform with a lower initial cost might require significant consulting hours, ultimately making it more expensive than an all-in-one solution.

- Demand a Personalized Demo: Generic, pre-recorded demos are not sufficient. Insist on a live, tailored demonstration where the vendor addresses your specific use cases. Provide them with a sample risk scenario or a compliance control from your framework and ask them to walk you through how their platform would manage it from start to finish. This is the ultimate test of a platform's real-world utility for your business.

Final Considerations Before You Commit

Choosing from the list of top risk management software is a strategic commitment. The right platform transforms risk management from a reactive, cost-centric function into a proactive, value-driving engine. It builds trust with customers, accelerates sales cycles by satisfying security questionnaires, and provides the leadership team with the visibility needed to make informed, strategic bets.

As you finalize your choice, remember that the most advanced technology is useless if it's not adopted. Prioritize user experience, intuitive workflows, and a system that empowers your team rather than creating another administrative burden. The ultimate goal is to embed risk-aware decision-making into your company's DNA, turning potential threats into opportunities for growth and resilience.

Ready to skip the complexity and achieve compliance goals at lightning speed? Comp AI leverages the power of AI to automate evidence collection, streamline audits, and get you SOC 2 or ISO 27001 certified faster than any other solution. Discover how our intelligent automation can transform your risk management process by visiting Comp AI for a demo.

Share this article

Help others discover this content

More from Compliance Hub

Explore more insights and stay ahead of regulatory requirements.

How to Get SOC 2 Certification The Smart Way

Learn how to get SOC 2 certification with our guide. We cover everything from readiness to audit, using automation to simplify the entire compliance process.

What Is Third Party Risk Management?

Learn what is third party risk management and why it's critical. Our guide breaks down the process, frameworks, and strategies for protecting your business.

Your Guide to a Compliance Automation Platform

Learn how a compliance automation platform transforms GRC strategy by streamlining tasks, reducing risk, and ensuring regulatory adherence.