If you're preparing for your first SOC 2 audit, you know the feeling: months of evidence gathering, endless screenshots, policy drafting from scratch, and the constant worry that you're missing something critical. Traditional compliance takes forever, costs a fortune in consulting fees, and often blocks enterprise deals while you scramble to get certified.

But here's the reality in 2025: compliance doesn't have to be a six-month nightmare. Modern compliance automation platforms are changing the game by using AI to handle the busywork, compress timelines from months to days, and keep you audit-ready without burning out your team.

This guide breaks down everything you need to know about compliance automation platforms in 2025. You'll learn what these platforms actually do, how they've evolved with AI, which one is right for your needs, and how to get audit-ready faster than you thought possible.

What Is a Compliance Automation Platform (And How Does It Work)?

A compliance automation platform is software that streamlines the entire compliance process, from evidence collection to audit preparation. Instead of manually gathering screenshots of your AWS configurations or tracking down proof that employees completed security training, these platforms connect directly to your systems and do it automatically.

Modern compliance automation platforms typically handle:

- Automated Evidence Collection: Connects to cloud platforms (AWS, GCP, Azure), identity providers (Okta, Google Workspace), HR systems, code repositories, and other tools to automatically pull evidence of controls

- Continuous Monitoring: Watches your infrastructure 24/7 and alerts you when something drifts out of compliance (like MFA being disabled or an S3 bucket becoming public)

- Policy Management: Generates compliance policies tailored to your tech stack using AI, saving hundreds of hours of manual writing

- Control Mapping: Maps your security controls to multiple frameworks (SOC 2, ISO 27001, HIPAA, GDPR) so one control can satisfy requirements across standards

- Trust Center: Creates a public-facing portal showing your security certifications and automatically answering vendor security questionnaires

- Audit Workflow: Provides a centralized workspace for auditors to request and review evidence, streamlining the entire audit process

The best platforms combine powerful automation with white-glove service, meaning you get both cutting-edge technology and human experts guiding you through every step.

Why Does Compliance Automation Matter (And Why Is Speed Critical)?

Here's a scenario that plays out thousands of times each year: a startup lands a huge enterprise deal, signs the contract, and then gets hit with a security questionnaire. The prospect requires SOC 2 certification before they'll onboard. The startup doesn't have it. The deal stalls for months while they scramble through a manual compliance process. Sometimes the deal dies completely.

Speed in compliance isn't just convenient. It's a revenue multiplier. Every day without certification is a day you can't close enterprise deals, expand into regulated industries, or satisfy investor requirements.

Traditional compliance approaches take 3-6 months just for SOC 2 Type I preparation. Add the required 3-month observation period for Type II, and you're looking at nearly a year from start to finish.

Modern compliance automation platforms compress that dramatically. Some platforms now get companies audit-ready in days instead of months. For example, we at Comp AI commit to getting teams SOC 2 Type I audit-ready in 24 hours and Type II ready in 14 days (before the required 3-month observation period begins).

This speed advantage isn't just marketing hype. One CTO switched from a traditional platform where his team was only 30% through SOC 2 after 4 months. After switching to a modern automation platform, they became audit-ready in a couple of days. That kind of acceleration can mean the difference between winning or losing million-dollar contracts.

How AI Changed Compliance: From Manual Checklists to Autonomous Agents

Early compliance automation (circa 2017-2020) was primarily about integrations and checklists. Platforms like the established players in the market connected to your cloud provider and HR system to pull some basic evidence, but you still did most of the work manually.

The game changed when AI entered the picture. Modern compliance platforms now use AI agents to:

→ Hunt for evidence autonomously: AI agents can navigate through dozens of systems, take screenshots, pull configurations, and document controls without human intervention

→ Draft policies intelligently: Instead of starting from blank templates, AI generates comprehensive security policies customized to your specific tech stack in minutes

→ Answer security questionnaires: When prospects send those dreaded 200-question security spreadsheets, AI can auto-fill accurate responses based on your actual controls and policies

→ Detect and prioritize risks: AI continuously scans your environment, identifies potential compliance gaps, and even suggests specific remediation steps

→ Generate audit-ready documentation: AI creates control narratives, evidence logs, and audit reports that meet auditor expectations

Not all AI is created equal, though. Early implementations learned hard lessons. Some platforms had their AI hallucinate evidence during audits, creating serious problems. The best platforms now combine AI with guardrails and human verification.

For instance, when checking if MFA is enabled, smart platforms use deterministic code to verify the actual technical state (true or false) rather than having AI interpret settings. AI handles the documentation and explanation, but hard facts come from direct system checks. This hybrid approach achieves 90%+ automation while maintaining the accuracy that audits demand.

What to Look For: Key Features of Modern Compliance Automation Platforms

When evaluating compliance automation platforms in 2025, prioritize these capabilities:

1. How Many Integrations Does the Platform Support?

The platform should connect to your entire tech stack:

| Integration Category | Common Tools |

|---|---|

| Cloud Infrastructure | AWS, Azure, Google Cloud |

| Identity & Access Management | Okta, Azure AD, Google Workspace |

| Code Repositories | GitHub, GitLab, Bitbucket |

| HR & Employee Systems | BambooHR, Workday, Gusto |

| Device Management | Jamf, Kandji, Intune |

| Ticketing & ITSM | Jira, Linear, ServiceNow |

Comp AI supports 100+ integrations to automatically collect evidence across your systems. The more integrations a platform offers, the less manual evidence gathering you'll do.

2. Does It Monitor Your Compliance Status Continuously?

Compliance isn't a one-time project. Your platform should monitor your environment continuously (some platforms check hourly) and immediately alert you to any drift. If someone disables MFA on a critical account or makes an S3 bucket public, you need to know instantly.

Continuous monitoring also means you stay audit-ready year-round instead of scrambling before each annual audit. When it's time for your next certification, you'll have clean evidence trails showing your controls operated effectively all year.

3. Can You Pursue Multiple Frameworks Simultaneously?

Most companies need more than one certification. You might start with SOC 2 to close US enterprise deals, then add ISO 27001 for European customers, then HIPAA when you expand into healthcare. A good platform should:

- Support 20+ frameworks out of the box

- Map controls across frameworks so one implementation satisfies multiple requirements

- Allow you to pursue multiple certifications simultaneously without duplicating work

Comp AI supports 25+ leading compliance frameworks including SOC 2, ISO 27001, HIPAA, GDPR, PCI-DSS, and even emerging AI governance standards like ISO/IEC 42001.

4. How Does the Trust Center Help You Close Deals Faster?

Your sales team shouldn't have to chase SMEs for security questionnaire answers. A modern platform provides:

- Public Trust Center: A live portal showcasing your certifications, security policies, and compliance status

- AI-Powered Questionnaire Automation: Automatically generates accurate answers to vendor security questions by referencing your actual policies and controls

- Answer Provenance: Links each questionnaire response back to specific policies and evidence so auditors (and prospects) can verify claims

Comp AI provides a real-time Trust Center that automatically answers security questionnaires using AI, helping your sales team close deals faster without constantly interrupting engineering.

5. What Level of White-Glove Support Do You Actually Get?

Technology alone isn't enough, especially for your first audit. Look for platforms that provide:

The difference between "we provide templates" and "we do it for you" is hundreds of hours of your team's time. Always ask about hands-on support during vendor evaluations.

What to expect from quality support:

- Dedicated compliance experts who guide you through the process

- Rapid response times (some platforms offer 5-minute response SLAs via dedicated Slack channels)

- Done-for-you configuration of integrations and policies

- Introductions to pre-vetted auditors who know the platform

- Proactive guidance on remediation when gaps are identified

Comp AI offers 100% done-for-you onboarding, a dedicated Slack channel with compliance experts, and 5-minute response times. We also provide a pre-vetted auditor network and a 100% money-back guarantee if you're not satisfied.

6. How Does the Platform Streamline the Actual Audit Process?

The platform should make the actual audit process smooth by providing:

- Secure evidence rooms where auditors can access organized documentation

- Direct auditor access to the platform (no emailing screenshots back and forth)

- Standardized control narratives that meet auditor expectations

- Automated evidence freshness verification

Compliance Automation Platform Comparison: Which Category Fits Your Needs?

The compliance automation market has matured significantly. Here's how the major categories break down:

| Platform Category | Best For | Key Characteristics |

|---|---|---|

| AI-First, Speed-Focused | Startups needing quick SOC 2 to unlock enterprise deals | Autonomous AI agents, aggressive speed claims (days not months), high-touch service, money-back guarantees |

| Established Automation Leaders | Companies wanting proven platforms with large user bases | Mature integration catalogs, extensive framework coverage (30+), thousands of customers, increasingly adding AI |

| Enterprise GRC Platforms | Large enterprises with dedicated compliance teams | Deep customization, audit committee oversight, enterprise-scale operations, significant implementation effort required |

AI-First, Speed-Focused Platforms

These platforms are designed for startups and fast-growing companies that need to get certified quickly. They emphasize autonomous AI agents, aggressive speed claims, and high-touch service.

Best for: Startups needing SOC 2 to unlock enterprise deals, companies with small teams that can't dedicate months to compliance

Examples: Modern platforms in this category claim readiness timelines measured in days rather than months, backed by money-back guarantees and dedicated expert support

Established Automation Leaders

These are the first-generation compliance automation platforms that pioneered the space. They offer mature integration catalogs, extensive framework coverage, and are increasingly adding AI capabilities.

Best for: Companies that want proven platforms with large user bases and extensive integration libraries

Examples: Platforms in this category typically have thousands of customers and robust support for 30+ frameworks

Enterprise GRC Platforms

These comprehensive governance, risk, and compliance suites serve large enterprises with dedicated compliance teams. They offer deep customization but require significant implementation effort.

Best for: Large enterprises with complex compliance needs, companies requiring extensive customization

Examples: Traditional GRC platforms designed for audit committee oversight and enterprise-scale operations

How Fast Can You Really Get Audit-Ready in 2025?

This is the question everyone asks, and the answer has changed dramatically with AI-powered platforms.

SOC 2, ISO 27001, HIPAA: Timeline Comparison (Traditional vs Modern)

| Compliance Type | Traditional Timeline | Modern Platform-Assisted | Comp AI Commitment |

|---|---|---|---|

| SOC 2 Type I | 3-6 months | 7-30 days | 24 hours |

| SOC 2 Type II | 6-12 months total | 2-4 weeks + 3-month observation | 14 days + observation |

| ISO 27001 | 6-12 months | 1-2 months | 14 days |

| HIPAA | 6-12 months | 2-4 weeks | 7 days |

| GDPR | 6-12 months | 2-4 weeks | 7 days |

Cost comparison:

- Traditional consulting: $50,000-$100,000+ in fees

- Hundreds of hours of internal staff time

- Often requires 3-6 months of work before audit can even begin

Comp AI has pushed these timelines even further, publicly committing to 24-hour SOC 2 Type I readiness and 14 days for Type II readiness. One real customer testimonial describes switching from a competitor (where they were only 30-40% done after 4 months) to being audit-ready in a couple days with Comp AI.

SOC 2 Type I vs Type II: What's the Difference?

It's important to understand the distinction:

- Type I is a point-in-time assessment showing your controls are designed properly and in place on a specific date

- Type II demonstrates your controls operated effectively over a period of time (minimum 3 months)

No platform can compress the Type II observation period (it's required by the standard), but they can get you ready to start that observation period immediately. This means instead of spending 3 months preparing then 3 months observing (6 months total), you spend 2 weeks preparing then 3 months observing (3.5 months total).

For companies with urgent deals on the line, getting to Type I quickly can be the difference between winning and losing a contract. Sales can truthfully tell prospects "we're SOC 2 certified" (Type I) while the Type II observation runs in the background.

How Fast Compliance Unlocks Revenue (Real Customer Stories)

The business impact of faster compliance is measurable. Companies report:

CUSTOMER SUCCESS STORY:"We were only 30-40% through SOC 2 after 4 months with our previous platform. We switched to Comp AI and they had us audit-ready in a couple of days." - CTO at Persona AI

Tangible business outcomes:

→ Closing deals faster: Enterprise prospects move through security reviews in days instead of months when you have a live Trust Center and can instantly provide proof of compliance

→ Unblocking revenue: Some companies report unlocking $500,000+ in ARR within weeks of getting audit-ready

→ Reducing sales cycle friction: Automated questionnaire responses mean security reviews no longer bottleneck deals

→ Entering new markets: Fast certification for HIPAA or GDPR enables rapid expansion into healthcare or European markets

One platform reported that their customers collectively saved over 2,500 hours of manual compliance work in their first few months. At a loaded hourly rate of $100-200 for engineering and compliance personnel, that translates to hundreds of thousands of dollars in saved labor costs.

What Does Compliance Automation Actually Cost in 2025?

Compliance automation platform pricing varies widely based on several factors:

What Factors Drive Pricing?

| Pricing Factor | Impact on Cost |

|---|---|

| Framework Count | SOC 2 only vs. SOC 2 + ISO 27001 + HIPAA + GDPR |

| Company Size | Headcount, cloud accounts, repositories, assets under management |

| Service Level | Self-service vs. white-glove done-for-you onboarding |

| Audit Bundling | Some platforms include auditor fee, others charge separately |

| Contract Length | Annual commitments vs. month-to-month flexibility |

What Should You Expect to Pay?

Based on publicly available information and press releases:

- Entry-level packages: Start as low as $3,000 for basic SOC 2 readiness

- Mid-range packages: SOC 2 with white-glove service typically $8,000-15,000

- Enterprise packages: Supporting multiple frameworks can reach $20,000-50,000+

Comp AI has packages starting as low as $3,000 with no annual contract required, positioned to be accessible for startups while including their AI automation and expert support.

Always ask vendors for itemized quotes that clearly separate platform fees from auditor fees, and understand exactly what's included in terms of hands-on support.

How to Choose the Right Compliance Platform for Your Company

Different organizations have different priorities. Here's how to match your needs to the right platform category:

For Startups That Need Certification Fast

Situation: You have an enterprise deal blocked by SOC 2 requirements. You have a small team (under 50 people) and can't dedicate months to compliance.

What to prioritize:

- Proven speed (documented case studies showing days to readiness, not months)

- White-glove service (you need experts doing it with you, not just software)

- Auditor network (platform should introduce you to auditors who know their system)

- Money-back guarantee (risk mitigation if timelines slip)

- Trust Center and questionnaire automation (to help sales close deals)

Best fit: AI-first platforms optimized for speed and service. Comp AI exemplifies this category with 24-hour SOC 2 Type I readiness claims, 100% done-for-you onboarding, pre-vetted auditors, and a money-back guarantee.

For Growing Companies Needing Multiple Certifications

Situation: You have SOC 2 but now need ISO 27001 for European customers and HIPAA for healthcare expansion. You want one platform to manage everything.

What to prioritize:

- Multi-framework support with control mapping

- Scalability as you grow from 100 to 500+ employees

- Integration breadth for increasingly complex tech stack

- Continuous monitoring to stay audit-ready year-round

Best fit: Platforms with comprehensive framework libraries and mature integration ecosystems. Comp AI supports 25+ frameworks with intelligent control mapping so you're not duplicating effort.

For Enterprises with Dedicated Compliance Teams

Situation: You have a dedicated GRC team, need deep customization, and must integrate compliance with broader risk management.

What to prioritize:

- Customizable workflows and fields

- Integration with existing GRC systems

- Advanced analytics and executive reporting

- Enterprise-grade access controls and data residency options

Best fit: Enterprise GRC platforms with comprehensive customization capabilities (though these require significant implementation time and resources).

5 Critical Questions to Ask Before You Buy

Use these questions during vendor evaluations to separate marketing from reality:

1. Can You Prove Your Speed Claims with Recent Case Studies?

"Show me three dated case studies from 2024-2025 where you got companies in my industry, with my tech stack, audit-ready in \[X\] days. Can I talk to those customers?"

Look for specific, verifiable examples. Generic claims about speed mean nothing without proof.

2. How Do You Prevent AI Hallucinations in Audit Evidence?

"How do you verify that your AI outputs are accurate? What guardrails prevent hallucinations or misstatements about my security controls?"

GOOD ANSWER"We use deterministic checks for technical controls (MFA, encryption, etc.), and AI handles documentation with human review for auditor-facing content. We've achieved 95%+ accuracy across hundreds of audits."

BAD ANSWER"Our AI is trained on millions of compliance documents and is very accurate." (No specific guardrails mentioned)

3. Who Actually Does the Work (You or Me)?

"Who exactly configures my integrations? Who writes my policies? Who chases down missing evidence? How fast do you respond to questions?"

The difference between "we provide templates" and "we do it for you" is hundreds of hours of your team's time.

4. Do You Work with Specific Auditors (And Can You Introduce Me)?

"Do you work with specific audit firms? Can you introduce me to an auditor who already knows your platform? What's the typical timeline once we're platform-ready to actual audit completion?"

An auditor who's never seen your platform will take longer and might request evidence in formats the platform doesn't natively provide.

5. What's Included in the Price (And What's Your Refund Policy)?

"Is the auditor fee included or separate? Are there additional fees for multiple frameworks? What happens if we don't pass the audit or miss our timeline? What's your refund policy?"

Comp AI offers a 100% money-back guarantee if you're not satisfied, which significantly reduces risk for first-time buyers.

6. How Does Your AI-Powered Trust Center Actually Work?

"Can I see your Trust Center in action? Show me how the AI answers a security questionnaire and how it links answers back to evidence. Can sales use this without involving engineering?"

This feature alone can save your team hours every week and directly accelerate sales cycles.

Common Compliance Automation Mistakes (And How to Avoid Them)

Pitfall 1: Believing AI Eliminates All Human Work

⚠️ CRITICAL REALITY CHECKEven the most automated platforms can't eliminate all human effort. AI can collect evidence and draft policies, but you still need to fix security gaps, review policies, complete training, and coordinate with auditors.

Smart platforms minimize this work and guide you through it, but expecting zero effort is unrealistic.

Pitfall 2: Ignoring the SOC 2 Type II Observation Period

You cannot compress the 3-month Type II observation period. Some buyers get frustrated when they're "audit-ready in 2 weeks" but still can't get their Type II report for another 3+ months.

Set correct expectations with stakeholders: fast readiness means you start the Type II clock immediately, but the calendar still runs 3 months.

Pitfall 3: Choosing Your Platform Based Only on Price

⚠️ BUSINESS IMPACT WARNINGThe cheapest platform might save $5,000 upfront but cost you $50,000 in lost deals if it takes 4 months instead of 2 weeks to get certified.

Consider the total cost including:

- Internal staff time

- Opportunity cost of blocked deals

- Risk of failed audits requiring do-overs

- Ongoing maintenance burden

Pitfall 4: Underestimating the Value of Expert Support

For first-time compliance, expert guidance is invaluable. A self-service platform might be $3,000 cheaper than one with white-glove service, but the hand-holding could be the difference between passing your audit on the first try and having to remediate findings and reschedule.

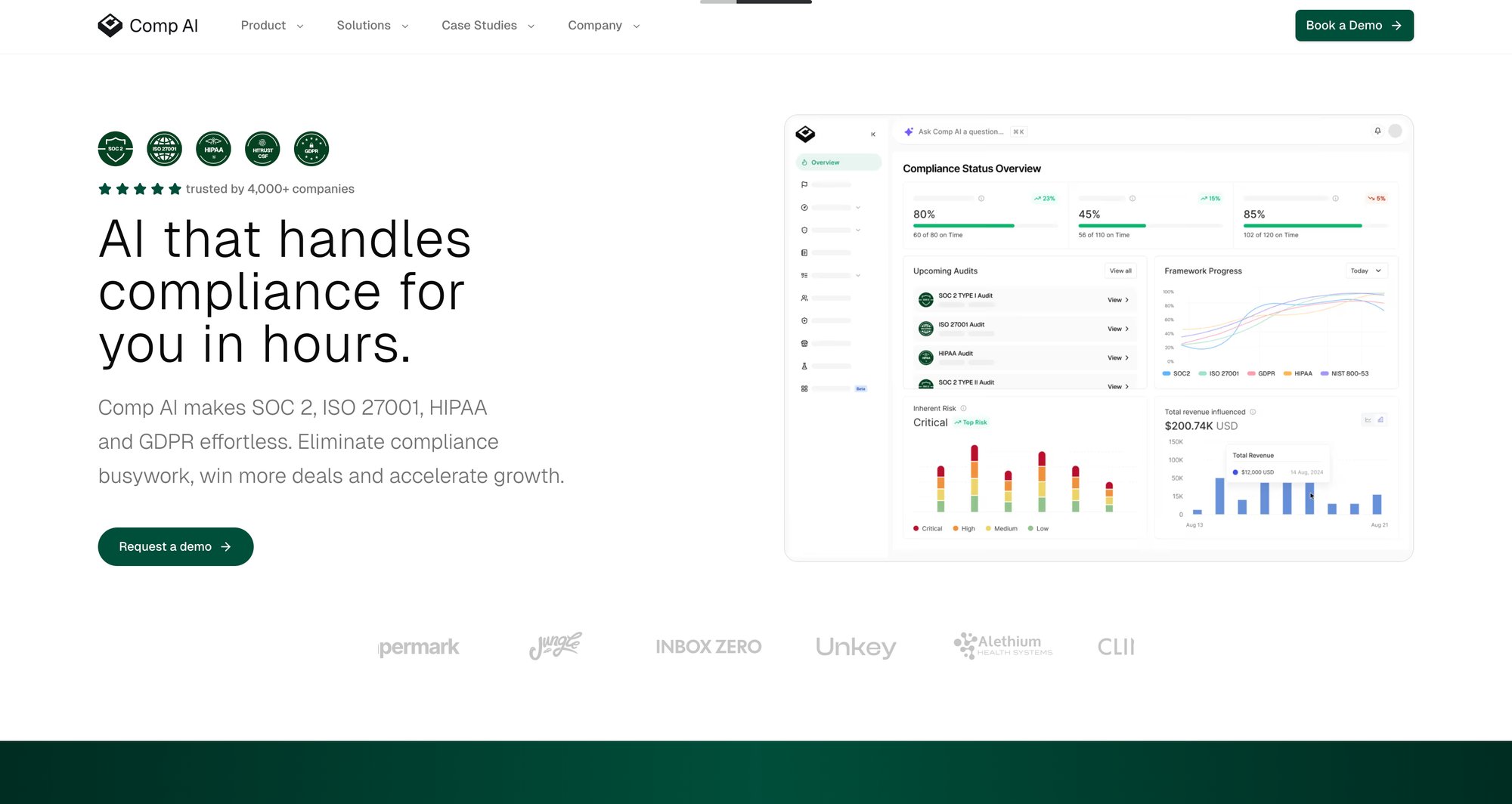

Why Comp AI Is the Fastest Path to Compliance in 2025

Comp AI represents the cutting edge of compliance automation in 2025. Here's why it stands out:

Audit-Ready in 24 Hours: Fastest Speed on the Market

Comp AI publicly commits to the fastest compliance timelines in the market:

→ SOC 2 Type I: Audit-ready in 24 hours

→ SOC 2 Type II: Audit-ready in 14 days (before 3-month observation)

→ ISO 27001: 14 days to audit-ready

→ HIPAA: 7 days to audit-ready

These aren't just marketing claims. Real customers have validated the speed. One CTO switched from a competitor where his team spent 4 months and only reached 30% completion. After switching to Comp AI, they were audit-ready in a couple of days.

AI Agents That Hunt Evidence Across 100+ Systems

Comp AI uses autonomous AI agents that:

→ Actively hunt for evidence across 100+ integrated systems

→ Take screenshots and collect configurations automatically

→ Generate comprehensive security policies tailored to your tech stack

→ Continuously monitor your infrastructure for compliance drift

→ Power an AI-driven Trust Center that auto-answers security questionnaires

The platform combines AI with deterministic checks and human verification, achieving high automation rates while maintaining the accuracy that audits demand.

100% Done-For-You Onboarding (No DIY Assembly Required)

Comp AI offers 100% done-for-you onboarding, meaning:

- We configure all integrations for you

- We customize all policies to your specific context

- You get a dedicated Slack channel with compliance experts

- We respond within 5 minutes during onboarding

- We introduce you to pre-vetted auditors who know the platform

This level of service turns what could be a months-long project into a focused sprint.

Real-Time Trust Center That Accelerates Your Sales Cycle

Comp AI provides a live Trust Center that:

- Showcases your certifications and security posture publicly

- Automatically answers vendor security questionnaires using AI

- Links every answer back to specific policies and evidence

- Updates in real-time as your compliance status changes

This means your sales team can handle security reviews without constantly pulling engineering into calls or spending days filling out spreadsheets.

100% Money-Back Guarantee (Zero Risk)

Comp AI backs our speed claims with a 100% money-back guarantee. If you're not satisfied with the platform or don't pass your audit, you get a full refund. This dramatically reduces the risk of trying a newer, faster platform.

Accessible Pricing Starting at $3,000

Comp AI has packages starting as low as $3,000 with no annual contract required. This makes AI-powered compliance accessible to even early-stage startups, while the white-glove service level matches or exceeds platforms costing 3-5x more.

Your 14-Day Roadmap to SOC 2 Readiness

Here's what a compressed SOC 2 readiness sprint looks like with a modern platform:

Day 0: Kickoff and Scoping (2 hours)

- Align on frameworks needed (SOC 2 Type I and/or Type II)

- Lock dates with both platform vendor and auditor

- Set up daily 15-minute standups for the sprint

Days 1-2: Connection and Evidence Collection

Platform configuration:

- Connect platform to cloud providers (AWS, GCP, Azure)

- Connect to identity provider (Okta, Google Workspace, Azure AD)

- Connect to HR system, code repositories, ticketing, MDM

Automated outputs:

→ Platform automatically pulls initial evidence and flags gaps

→ AI generates first draft of all required policies

Days 3-5: Remediation Sprint

Fix high-impact gaps identified by platform:

- Enable MFA everywhere it's missing

- Encrypt unencrypted S3 buckets

- Configure proper backup retention

- Ensure all devices meet security baselines

- Activate continuous monitoring alerts

Days 6-7: Policy Finalization and Internal Review

- Review and approve AI-generated policies

- Assign final evidence collection tasks to team members

- Configure Trust Center with initial content

- Test questionnaire automation with a real vendor questionnaire

Days 8-10: Auditor Pre-Check

- Auditor reviews evidence completeness

- Freeze control narrative language

- Final policy attestations from leadership

- Clear any outstanding findings

Days 11-14: Start Type II Observation

Beginning the 3-month observation period:

→ Begin the 3-month observation period for Type II

→ Continuous monitoring keeps evidence fresh automatically

→ Sales can now truthfully say audit is in progress

→ Trust Center goes live to handle security questionnaires during observation

This sprint requires dedicated focus but is achievable for cloud-native companies with reasonable starting security hygiene. Even companies with significant gaps typically complete remediation within 3-4 weeks using platform guidance.

Compliance Automation FAQs: Your Questions Answered

Can I really get SOC 2 certified in 24 hours?

You can get audit-ready in 24 hours with the right platform (specifically prepared for the audit to begin), but the full certification process takes longer. For SOC 2 Type I, you can be ready for the auditor in a day, then the audit itself takes 1-2 weeks. For Type II, you can be ready to start the observation period in days or weeks, but the observation must run for at least 3 months before the audit can be completed.

How is compliance automation different from traditional consulting?

Traditional consulting is labor-intensive and expensive. Consultants manually guide you through building policies, gathering evidence, and preparing for audits. Compliance automation platforms use software and AI to automate 80-90% of this work, with human experts available for guidance. This combination is faster, more affordable, and keeps you audit-ready continuously rather than requiring a big prep project every year.

What happens if I fail my first audit?

With good platforms offering money-back guarantees, your financial risk is minimal. More importantly, platforms with white-glove service and pre-vetted auditors significantly reduce the likelihood of failure. Comp AI offers a 100% money-back guarantee and works with auditors who already know their platform, minimizing surprises.

Can these platforms handle multiple frameworks simultaneously?

Yes, the best platforms support simultaneous pursuit of multiple frameworks. They map controls across standards so a single security control can satisfy requirements in SOC 2, ISO 27001, HIPAA, and GDPR. This dramatically reduces duplicate work when you need multiple certifications.

How much ongoing effort is required after initial certification?

With continuous monitoring, ongoing effort is minimal. The platform automatically collects evidence year-round, alerts you to any compliance drift, and prepares you for renewal audits. Most customers report spending just a few hours per quarter on compliance maintenance versus weeks of prep before each annual audit in the old model.

Are AI-generated policies acceptable to auditors?

Yes, as long as they're accurate and tailored to your actual implementation. The best platforms use AI to draft policies but have compliance experts review them and customize them to your specific tech stack and controls.

Auditors care that policies are accurate and that you actually follow them. They don't care whether a human or AI wrote the first draft.

What about the security of the platform itself?

Reputable compliance platforms are typically SOC 2 Type II certified themselves and follow strict security practices. They encrypt data at rest and in transit, maintain audit logs of all access, and often allow you to control data residency. Always ask to see the platform's own SOC 2 report before selecting them.

Can I switch platforms mid-compliance?

It's possible but disruptive. Most evidence should be portable (you own your policies, evidence screenshots, etc.), but you'll lose platform-specific automations and may need to reconfigure integrations. If you're unhappy with a platform early on, switching before your first audit is much easier than switching afterward.

The Bottom Line: Choose Speed, AI, and Service

Compliance in 2025 is fundamentally different than it was even two years ago. AI has made it possible to compress months of manual work into days of automated evidence collection and policy generation. But technology alone isn't enough. The best outcomes come from platforms that combine cutting-edge AI with white-glove human expertise.

If you're choosing a compliance automation platform, prioritize:

- Proven speed (documented case studies with specific timelines, not vague claims)

- AI with guardrails (automation that's accurate, not just fast)

- White-glove service (experts who do the work with you, not just provide software)

- Auditor relationships (platforms with pre-vetted auditors reduce risk and timeline)

- Trust Center and questionnaire automation (features that accelerate sales, not just compliance)

- Risk mitigation (money-back guarantees, transparent pricing, no long-term lock-in)

Comp AI exemplifies this next generation of compliance automation: 24-hour SOC 2 Type I readiness, autonomous AI agents, 100% done-for-you service, a real-time Trust Center for sales velocity, pre-vetted auditors, and a 100% money-back guarantee. Packages start at $3,000 with no annual contract.

If compliance has been blocking your growth, 2025 is the year to solve it. The right platform can turn a six-month compliance nightmare into a two-week sprint, unlocking enterprise deals and enabling you to focus on building your product instead of chasing screenshots.

Ready to get audit-ready in days, not months? Explore Comp AI to see how AI-powered compliance automation can accelerate your certification and revenue growth.

Share this article

Help others discover this content