If you're a CISO, risk leader, IT/security owner, compliance head, or founder trying to pick risk management software in 2025, you know the drill: the market's crowded, pricing is opaque, and your boss wants results yesterday. You need to select, justify, and successfully deploy a platform without wasting cycles or budget.

Here's what you'll get: a clear market map, category winners, actual pricing realities for 2025, a selection rubric you can use today, an RFP checklist, a deployment plan, and the regulatory context driving requirements this year.

What You Need to Know Before Buying Risk Management Software (2025 Edition)

First, understand that "risk management software" isn't one tool. The market splits by primary job:

1. Enterprise IRM/GRC (multi-risk, multi-framework, audit-grade workflows)

2. Third-Party Risk (TPRM)

3. Cyber Risk Quantification (CRQ)

4. AI/Model Risk & AI Governance

5. Mid-market/Startup GRC aligned to compliance programs

The winners in 2025 aren't the ones with the most features. Fast, usable, integrated beats feature-bloat every time. Prioritize: time-to-value, control mapping, integrations, reporting that stakeholders actually use, and automation/AI that removes work instead of creating it.

Pricing in 2025 is mostly quote-based, but here are the reasonable starting ranges we're seeing:

| Segment | Annual Cost Range | Notes |

|---|---|---|

| Mid-market GRC (1-2 frameworks) | ~$12k-$50k/yr | Hyperproof publicly lists "Starting at $12,000/year" |

| Enterprise IRM/GRC suites | ~$50k-$500k+ | Depends on modules, entities, users, services. ServiceNow often involves subscription plus partner implementation |

| Specialist TPRM / CRQ | ~$25k-$200k+ | Wide range driven by portfolio size and data needs |

| Starting at $3,000 | Compliance automation with transparent pricing, no annual contracts |

Regulatory drivers in 2025 will shape your requirements:

EU AI Act obligations start phasing in August 2, 2025 for prohibited/high-risk provisions, with full compliance phases running into 2026-27.

SEC cyber incident disclosure rule enforcement focus sharpened in 2025, covering material incident 8-K filings and board oversight. Learn more from AP News.

DORA (EU) applies from January 17, 2025 across financial services and critical ICT providers, mandating operational resilience, third-party risk, and testing requirements.

Success equals adoption. The best platform is the one your organization will actually use: consistent risk intake, living risk register, mapped controls, continuous monitoring, effortless reporting.

How to Use This Risk Management Software Buyer's Guide

Shortlist fast: Use the "Quick Picks by Job-to-Be-Done" list below to narrow your options immediately.

Verify fit: Scan the category deep dives to confirm scope and watch-outs for your specific needs.

Run procurement: Copy the RFP checklist and scoring rubric directly into your vendor evaluation process.

Land value: Follow the 30/60/90 adoption plan to ensure your team actually uses what you buy.

Best Risk Management Software by Use Case: Quick Picks for 2025

We list 1-2 "Best for" picks per job, plus strong runners-up.

1) Enterprise IRM/GRC (multi-risk, enterprise scale)

→ Best for cohesive enterprise program: OneTrust GRC / Integrated Risk. Strong recognition in 2025 IRM analyst research; breadth across privacy, TPRM, and risk

→ Best for audit, controls & assurance at scale: AuditBoard. Modern UX and tight audit/risk workflows; trusted by many public companies

→ Also consider: ServiceNow Risk & Compliance (powerful if you're already a ServiceNow shop), Archer IRM, IBM OpenPages, MetricStream, LogicGate, Diligent One (formerly Galvanize/HighBond)

2) Third-Party Risk (TPRM) & external attack surface ratings

| Need | Top Pick | Why |

|---|---|---|

| Deep TPRM & exchanges | ProcessUnity, OneTrust TPRM | Mature questionnaires, vendor exchanges, tight privacy+TPRM |

| External security ratings | SecurityScorecard, BitSight | Broad ecosystem and monitoring coverage |

Also consider: RiskRecon, Panorays, UpGuard, Prevalent, Aravo

3) Cyber Risk Quantification (CRQ)

Best for FAIR-based quant: RiskLens (pioneer in FAIR methodology)

Modern CRQ plus financial language: SAFE Security and Axio translate cyber risk into executive-friendly financial terms

4) AI/Model Risk & AI Governance

2025 PRIORITY: With the EU AI Act phasing in starting August 2, 2025, AI governance is no longer optional. Organizations need model inventory, impact assessments, and documented controls.

Best dedicated AI governance: Credo AI leads in model risk, policy frameworks, and enterprise controls, with rapid adoption alongside EU AI Act compliance needs.

Also consider: Holistic AI, IBM OpenPages MRM, ServiceNow AI governance capabilities (if already standardized on that platform)

5) Mid-market / Startup-friendly GRC (compliance-heavy)

- Hyperproof: Public pricing "Starting at $12,000/year," with risk register, controls, and evidence workflows geared to fast time-to-value

- Comp AI: Starting at $3,000, achieves SOC 2 readiness in 24 hours with automated evidence collection

- LogicGate: No-code workflows for custom risk processes

- Resolver: Operational and enterprise risk for mid-market

What is Risk Management Software and Why Does Your Organization Need It?

Having the right risk management software is mission-critical. Organizations face escalating risks on all fronts: cyberattacks, compliance violations, supply chain disruptions, and more. Consider the numbers: ransomware costs are projected to hit $265 billion per year by 2031 (up from $42B in 2024), and over 32% of critical vulnerabilities in enterprises stuck around for more than 6 months without patches.

These figures show why companies can no longer manage risk with spreadsheets and siloed tools. Modern integrated risk management (IRM) platforms bring all these risk areas together, aligning threat intelligence, compliance metrics, third-party/vendor oversight, and governance frameworks into a unified approach.

What is Risk Management Software?

At its core, risk management software helps organizations identify, assess, monitor, and mitigate risks across the business. Unlike ad-hoc methods, top platforms provide a centralized risk register, real-time analytics (dashboards, heat maps), and workflow automation so nothing slips through the cracks. These systems go beyond basic risk tracking by integrating with your IT stack, making incident reporting and audits easier, and often including compliance management modules for frameworks like ISO 27001, SOC 2, PCI-DSS, and GDPR.

In 2025, the best solutions use AI for tasks like scanning infrastructure for vulnerabilities, analyzing emerging threats, and suggesting remediation steps.

12 Best Risk Management Platforms for 2025: In-Depth Reviews

We've curated 12 of the top risk management software platforms in 2025. This list covers both the heavyweight integrated GRC/IRM systems used by large enterprises and innovative newcomers using AI and automation.

1. Comp AI: AI-Powered Compliance Risk Management

Overview: Comp AI is a newer entrant that takes a unique AI-first approach to risk and compliance management, focusing specifically on information security and regulatory compliance risks (such as SOC 2, ISO 27001, HIPAA, GDPR).

Unlike traditional GRC platforms, Comp AI is positioned as an automated compliance platform that can get companies audit-ready for certifications in unprecedented time (sometimes within days). As of 2025, Comp AI has gained attention as the "fastest way to get compliant," with claims of helping 4,000+ companies achieve frameworks like SOC 2, HIPAA, and ISO 27001 in record time.

| Feature | Traditional Approach | Comp AI Approach |

|---|---|---|

| SOC 2 Type I Prep | 3+ months | 24 hours average |

| SOC 2 Type II Prep | 6+ months | ~14 days to readiness |

| Evidence Collection | Manual, spreadsheet-based | 100+ integrations, AI bots auto-gather |

| Policy Generation | Manual drafting, legal review | AI-generated, compliance-ready templates |

| Vendor Risk | Manual questionnaires | AI risk engine monitors continuously |

Notable Features & Strengths:

Lightning-Fast Compliance Automation: Comp AI's headline promise is to get organizations "audit-ready in hours, not months." Their average time to prepare a company for a SOC 2 Type I audit is just 24 hours, versus the typical 3+ months. For SOC 2 Type II, they target around 14 days to readiness (versus 6+ months).

AI Agents for Evidence Collection: Comp AI uses "agentic" AI bots that connect to your systems (AWS, GitHub, Okta) to automatically gather evidence of controls. Over 100 integrations are supported, dramatically reducing the manual work of screenshot-taking and documentation gathering.

AI-Powered Policies and Risk Intelligence: The platform uses AI to generate necessary policies and analyze risks. It also has an AI risk engine that continuously researches things like your vendors' security and monitors for new internal risks.

REAL-WORLD VALUE: "We spent 6 months preparing for SOC 2 the traditional way, only to fail because our evidence was incomplete. Starting over cost us a major enterprise deal. With Comp AI, we were audit-ready in 3 weeks and passed on the first try." – CTO, Series B SaaS Startup

Realtime Trust Center & Questionnaire Automation: Comp AI includes a public-facing Trust Portal where customers can view your compliance status and certificates in real-time. It also features an AI chatbot that auto-answers security questionnaires from clients, dramatically reducing sales friction.

White-Glove Service with AI Efficiency: They provide 1:1 Slack support with compliance experts and offer a "100% Done For You" approach where their team handles the heavy lifting. Comp AI offers a 100% money-back guarantee if a customer isn't satisfied or can't achieve compliance.

Comp AI is specialized in IT security and compliance risk management. It's ideal for achieving certifications but not designed to manage all types of enterprise risk (financial risk, operational safety, ESG). Organizations needing comprehensive ERM should use Comp AI for the compliance portion and supplement with other tools.

Best for: Startups, tech companies, and agile mid-size firms that need to get compliant fast and with minimal overhead. For the realm of security/compliance risk management, Comp AI represents the next generation of tools that use AI to eliminate months of manual work.

2. ServiceNow Governance, Risk, and Compliance (GRC)

Overview: ServiceNow GRC is an enterprise-grade integrated risk management platform that builds on ServiceNow's popular workflow and IT service management ecosystem. It embeds risk and compliance processes into daily operations on the ServiceNow Now Platform (a big advantage for organizations already using ServiceNow for ITSM, security incident response, and similar functions).

Notable Features & Strengths:

→ Deep Workflow Integration: Because it runs on the Now Platform, ServiceNow GRC hooks into IT operations seamlessly. Risk assessment and control tasks link with asset inventories and incident response processes

→ Continuous Monitoring & Risk Scoring: The platform provides continuous control monitoring, risk scoring, and compliance tracking. It can ingest data from vulnerability scanners and threat feeds to update risk scores in real time

→ Policy & Compliance Management: ServiceNow GRC comes with templates for common frameworks (ISO 27001, SOC 2, HIPAA, PCI) and maps your internal controls to these requirements

→ Third-Party Risk Module: It includes a vendor risk management capability, so you can assess and track risks from suppliers or partners

→ Scalability and Platform Ecosystem: A big strength is the ServiceNow ecosystem. Organizations can extend GRC with other ServiceNow apps (ITSM, HR) and use the platform's AI (Now Intelligence) for analytics

Potential Drawbacks:

ServiceNow GRC is powerful but complex to configure and administer, especially for organizations that aren't already ServiceNow customers. As an enterprise solution, it tends toward the higher end of pricing. Implementation typically requires experienced partners and can take several months to fully deploy across the organization.

Best for: Medium to large enterprises, especially those already using ServiceNow or those who need strong IT integration.

3. RSA Archer Suite

Overview: RSA Archer has long been a trusted name in governance, risk, and compliance. It's a suite of GRC solutions with a modular approach that allows organizations to implement different modules for enterprise risk, IT risk, operational risk, compliance management, audit, third-party risk, and more.

Archer's comprehensive module library offers a broad range of out-of-the-box solutions covering IT risk management, cyber incident tracking, operational risk, SOX compliance, internal audit management, business continuity, and vendor risk management. The platform is known for its highly configurable workflows that let companies customize forms, fields, calculations, and processes without coding. Archer provides solid reporting tools where users can build risk heat maps, trend charts, and executive dashboards. As one of the earliest GRC platforms, Archer has a large install base and deep industry knowledge.

However, Archer's user interface has improved over the years but some still find it less intuitive and more dated compared to newer SaaS products. Like ServiceNow, Archer is an enterprise solution with enterprise pricing, typically requiring dedicated resources to configure and maintain the platform effectively.

Best for: Large enterprises and upper mid-market firms in regulated sectors that need a tried-and-true, highly customizable GRC platform.

4. MetricStream Integrated Risk Platform

Overview: MetricStream is a globally recognized leader in integrated risk management and GRC solutions, known for serving heavily regulated industries such as banking, insurance, healthcare, and energy.

| Coverage Area | Capabilities |

|---|---|

| Enterprise-Wide Risk | ERM, IT and cyber risk, regulatory compliance management, policy management, audit management, ESG risk |

| AI-Powered Intelligence | Risk analytics engine that analyzes large volumes of risk data to identify patterns and emerging threats |

| Regulatory Content | Built-in libraries of risks, controls, and regulatory requirements that reduce setup time |

| Scalability | Built for large-scale deployments handling thousands of users and huge datasets |

MetricStream's AI-powered risk intelligence engine can analyze large volumes of risk data to identify patterns and emerging threats before they materialize. The platform comes with built-in libraries of risks, controls, and regulatory requirements that significantly reduce the time needed to stand up a GRC program. MetricStream is built for large-scale deployments and can handle thousands of users and huge datasets while maintaining security and performance.

⚠️ IMPLEMENTATION REALITYImplementing MetricStream can be a major project taking several months, often requiring consultants who specialize in the platform. Organizations should budget for both software costs and significant professional services.

Best for: Large and global enterprises that need a comprehensive, integrated GRC platform with advanced analytics, particularly those in heavily regulated industries.

5. IBM OpenPages GRC Platform

Overview: IBM OpenPages is a mature integrated risk management platform that's been a staple in the industry, especially among financial and large corporate institutions. OpenPages stands out for its analytics and AI integration, courtesy of IBM Watson.

OpenPages integrates with IBM Watson AI to enhance risk analysis capabilities. The Watson integration can process unstructured data from documents, news feeds, and internal communications to identify risk signals that might otherwise be missed. IBM OpenPages brings together diverse data sources into a unified risk data model, providing a single source of truth for risk information across the enterprise. This unified view helps break down silos and ensures consistent risk assessment.

The platform offers modules for operational risk, policy and compliance management, IT risk, model risk, third-party risk, and internal audit. Each module can be deployed independently or as part of an integrated suite. This modular approach gives organizations flexibility in how they expand their risk program over time.

OpenPages can be complex to set up and may work best if you're aligned with the IBM ecosystem and have access to IBM expertise. IBM solutions typically come at a premium, and organizations should factor in both licensing costs and implementation services when budgeting.

Best for: Large enterprises, particularly in financial services or other data-intensive industries, that want a data-driven risk management program and have the resources to invest in a sophisticated platform.

6. OneTrust GRC

Overview: OneTrust has rapidly emerged as a leader in the risk and compliance software space, using its origins in privacy management to expand into full-fledged GRC. In 2025, OneTrust was named a Leader in the IDC MarketScape for Worldwide GRC Software.

All-in-One Platform Approach:

OneTrust provides modules that cover third-party risk management, IT & security risk, compliance management, audit, ethics and compliance, and even ESG risk. This breadth means organizations can manage multiple risk domains in a single platform rather than juggling separate tools. The platform reduces complexity and improves visibility across risk areas.

OneTrust offers pre-built templates and automated workflows for assessments and uses an AI engine named Athena to analyze risk data and suggest actions. Athena can help prioritize risks based on business impact, recommend controls, and even draft policy language based on regulatory requirements. OneTrust is particularly strong in vendor/third-party risk, with automated vendor assessments, continuous monitoring, and integration with security rating services. The vendor risk module includes questionnaire templates, risk scoring, and workflows for vendor onboarding and ongoing assessment.

DEPLOYMENT ADVANTAGE: OneTrust is often praised for its relatively quick setup and intuitive interface compared to legacy GRC platforms. Many organizations can be up and running in weeks rather than months.

One limitation is that OneTrust might not natively incorporate external cyber risk signals to the same degree as dedicated security rating services, though it does integrate with these services.

Best for: Organizations of all sizes that want a modern, user-friendly risk and compliance platform with strong privacy and third-party risk capabilities.

7. SAP GRC

Overview: SAP GRC is a suite of risk and compliance tools that integrate tightly with SAP's enterprise software ecosystem. It's widely used by companies that run their core business processes on SAP.

The biggest advantage is that it works within your SAP applications, allowing you to monitor segregation of duties, access controls, and financial reporting risks directly in the systems where your business operates. This embedded approach reduces the risk of control gaps and provides real-time visibility into compliance status.

SAP GRC excels at managing financial reporting risks and operational controls, particularly for organizations that need SOX compliance. The Process Control module allows continuous monitoring of control performance and automated testing of key controls, dramatically reducing the manual effort required for compliance programs.

However, SAP GRC is fantastic for managing risks within SAP systems, but less comprehensive for external or non-SAP contexts like third-party risk or cyber risk quantification. Organizations typically need to supplement SAP GRC with other tools for these areas.

Best for: Large enterprises running SAP as their core business system that want to embed risk management into their ERP and financial processes.

8. NAVEX IRM (Lockpath)

Overview: NAVEX IRM (formerly Lockpath) is an integrated risk management solution that offers a centralized, policy-to-risk view of an organization's operations.

Key Capabilities:

- Unified Risk & Policy Management linking policies, controls, and risks in one system

- Operational Risk & Incident Tracking with strong capabilities for managing incidents, issues, and findings

- Automation & Workflow features to streamline risk processes and reduce manual overhead

NAVEX IRM emphasizes linking policies, controls, and risks in one system, so organizations can trace from high-level policies down to specific controls and risk assessments. This traceability is valuable for demonstrating governance to auditors and regulators. The platform has strong capabilities for operational risk management, incident tracking, and issue management. Organizations can log incidents, track investigations, and manage remediation plans in a centralized workflow.

Often praised for ease-of-use, NAVEX IRM may have slightly less depth than some heavyweight competitors like Archer or MetricStream in terms of advanced analytics or extensive module libraries.

Best for: Small to mid-sized enterprise organizations that want an integrated, easy-to-adopt risk management system without the complexity of larger platforms.

9. Riskonnect Integrated Risk Management

Overview: Riskonnect is a solid cloud-based risk management platform that originated in the insurance and risk finance domain. It's especially popular for organizations that want to bring together safety management, incident/claims management, and enterprise risk.

Riskonnect excels at the operational risk level, particularly for organizations with physical operations. Health and safety incident tracking, claims management, and workers' compensation integration are core strengths. The platform is designed to pull data from various sources into a unified risk view, helping organizations connect the dots between different risk events and identify enterprise-level patterns. Riskonnect offers strong integration with other enterprise software, particularly in the insurance and finance domains, helping organizations manage the full lifecycle of risk from identification through insurance placement and claims.

The platform is ideal if you have tangible operational risks (safety, property, liability) and insurance concerns, but may be less focused on purely cyber or compliance-driven risk programs.

Best for: Mid-to-large enterprises in sectors like manufacturing, transportation, healthcare, construction, or energy where operational risk and safety management are primary concerns.

10. LogicGate Risk Cloud

Overview: LogicGate Risk Cloud is a highly flexible, configurable risk and compliance platform that lets organizations build custom risk workflows with little to no coding.

LogicGate's developer-friendly approach extends beyond their no-code builder—the screenshot above shows their comprehensive API documentation, enabling technical teams to integrate Risk Cloud deeply into existing systems. At the bottom of the page, you can see a preview of their actual platform interface, showcasing the modern dashboard design and data visualization capabilities that set LogicGate apart from legacy GRC tools.

What Makes LogicGate Unique:

LogicGate's biggest selling point is its visual workflow builder that allows risk teams to design processes that match their organization's specific needs without requiring IT resources or coding skills. This no-code approach dramatically reduces time-to-value. The platform offers a library of pre-built applications for common GRC use cases (enterprise risk, vendor risk, audit, compliance, business continuity), which organizations can use as-is or customize to their needs.

In 2025, LogicGate has rolled out AI enhancements that provide predictive analytics, helping organizations identify which risks are likely to escalate and which controls are most effective. Users frequently highlight LogicGate's clean and modern UX, which makes adoption easier compared to legacy platforms with complex interfaces.

The flip side of flexibility is that you need to build out your processes and configure the platform to your needs, which requires some investment of time and thought upfront.

Best for: Mid-sized and growing companies that value agility and customizability, and have the internal capacity to design and configure their risk processes.

11. AuditBoard (Audit & Risk)

Overview: AuditBoard is a leading cloud-based platform originally built for internal audit management, which has expanded into risk management and compliance.

AuditBoard exemplifies the shift toward modern, user-friendly GRC platforms. The screenshot above shows their homepage messaging—"AI-led GRC built for the modern enterprise"—reflecting their focus on bringing contemporary UX and automation to traditionally clunky audit and risk processes. Their platform emphasizes ease of use and rapid deployment, which contrasts sharply with legacy solutions.

| Module | Primary Use Case | Key Benefit |

|---|---|---|

| AuditBoard Core | Internal audit management | SOX compliance automation |

| RiskOversight | Enterprise risk register | Real-time risk monitoring |

| PolicyHub | Policy management | Attestation workflows |

AuditBoard is an industry favorite for managing internal audits or SOX compliance, with features specifically designed for audit planning, fieldwork, workpaper management, and issue tracking. The RiskOversight module lets you maintain an enterprise risk register, conduct risk assessments, and link risks to controls and audit activities. This integration provides a complete view of the risk and control environment.

The platform automates repetitive work like sending control attestations, tracking remediation status, and generating audit reports, freeing up audit and risk teams to focus on higher-value analysis and advisory work.

⚠️ SCOPE CONSIDERATION: AuditBoard is fundamentally audit-centric, so while it handles risk well, organizations needing deep third-party risk management or cyber risk quantification might need supplemental tools.

Best for: Organizations that have a significant internal audit, SOX, or compliance program and want a modern platform that unifies audit and risk management.

12. Onspring GRC Platform

Overview: Onspring is a cloud-based GRC and risk management platform known for its no-code configurability and responsive user interface. The platform emphasizes ease of use and rapid deployment.

Onspring's drag-and-drop process builder lets you create or modify processes easily without writing code or engaging IT resources. This empowers risk and compliance teams to adapt quickly as business needs change. The platform shows key data like open risks, outstanding tasks, compliance status, and control performance in real-time dashboards with customizable widgets and automated notifications.

Onspring is good at pulling in data from external sources (other business systems, spreadsheets, APIs) and combining it with manually entered data, providing a comprehensive risk picture without forcing organizations to replace their entire tech stack.

Onspring is not as widely known as ServiceNow or Archer, which may matter for organizations that prioritize vendor stability or prefer platforms with large user communities and extensive third-party integrations.

Best for: Mid-market companies and agile enterprises that want a user-friendly, highly configurable GRC platform without the complexity and cost of enterprise-scale solutions.

The 2025 Landscape at a Glance

Why freshness matters: Leadership, product scope, and M&A continue to reshape the field. For example, Riskonnect rolled up business continuity leaders (Castellan in 2022) and acquired Camms (2024) to expand resilience plus strategic planning. This shows that buyers want operational resilience, risk, and planning in one motion.

Analyst/market signals (what they mean for buyers):

OneTrust highlighted by IDC in the Leaders category for integrated risk (2025), showing strong suite cohesion across privacy/TPRM/risk. This recognition validates OneTrust's platform approach for organizations considering an all-in-one solution.

AuditBoard continues to score well in risk plus audit user satisfaction (2025 peer grids), showing faster adoption in audit-driven programs. High satisfaction scores suggest easier change management for organizations rolling out new risk platforms.

G2 buyer grids (2025) show intense competition in TPRM (OneTrust, ProcessUnity, SecurityScorecard, RiskRecon, UpGuard, Panorays). This confirms you should shortlist by data model, exchanges, and integrations, not brand alone.

What Great Risk Management Software Must Do in 2025

1. Create a living risk register (not a shelf-ware spreadsheet)

Your risk register should support continuous intake, assessment, treatment, and monitoring with automated workflows and real-time updates. Static spreadsheets might work for a quarter, but they quickly become outdated and lose credibility.

2. Map risks to controls and evidence

Every risk should link to the controls that mitigate it, and every control should link to evidence (policies, tech configurations, tickets, training records, third-party documents). This mapping is essential for demonstrating effective risk management to auditors and boards.

3. Automate questionnaires, attestations, and evidence collection as much as possible

The platforms that win in 2025 are those that eliminate manual work. Automated questionnaires for third parties, automated evidence collection from your tech stack, and automated control testing save hundreds of hours per compliance cycle.

4. Integrate your reality

Your risk platform must connect with your IdP/SSO, cloud/IaC, ticketing systems, asset/CMDB, EDR, HRIS, data platforms, and privacy tools. Without these integrations, you're back to manual data entry and copy-paste workflows.

5. Report to multiple audiences

Different stakeholders need different views. Boards want financial impact and heat maps. Executives want KPIs and KRIs. Auditors need testable evidence. Customers want trust portal visibility. Your platform should support all these reporting needs without custom development.

6. Support current regulations

In 2025, your platform must help you comply with SEC cyber disclosure requirements (US), DORA operational resilience (EU financial services), EU AI Act (AI governance), and sector-specific mandates. Choose platforms that update their frameworks as regulations evolve.

What Does Risk Management Software Actually Cost in 2025?

Mid-market "compliance-first" GRC commonly starts ~$12k-$50k/yr for a single team/framework. Hyperproof's public page anchors the low end at $12k/year, providing a transparent baseline for budget planning.

Enterprise IRM/GRC spans ~$50k-$500k+, depending on modules (TPRM, BCM, SPM, audit, CRQ, AI governance), user/entity counts, and services. ServiceNow frequently involves subscription plus partner setup, so budget accordingly for both licensing and implementation costs.

TPRM & Ratings pricing scales with vendor count and monitoring depth. Think $25k-$200k+ as a planning range, with costs increasing based on the number of vendors assessed and the depth of continuous monitoring required.

CRQ depends on use case scope (pilot vs enterprise). Include services for model buildout and controls data feed when budgeting, as the technical implementation of quantitative risk models requires specialized expertise.

Remember: 2025 quotes vary widely. Negotiate bundles (TPRM plus privacy, or risk plus audit) and ask vendors to price against time-to-value milestones, not just seats. This aligns vendor incentives with your business outcomes.

Risk Management Software RFP Checklist: Copy & Use This Template

Program fit

- Primary job: IRM? TPRM? CRQ? AI governance? Compliance-first GRC?

- Evidence: native repository plus control tests? Map to frameworks (SOC 2, ISO 27001, HIPAA, NIST CSF, DORA)?

- Risk methodology: qualitative and quantitative? FAIR support?

Automation & integrations

- Third-party questionnaires, exchange content, and auto-scoring?

- External ratings ingestion (SecurityScorecard/BitSight)?

- Technical evidence: IdP/SSO, cloud, ticketing, CMDB, vulnerability scanners, EDR, data discovery

- AI assistance: policy mapping, control suggestions, remediation guidance (with guardrails and human-in-loop)?

Reporting & governance

- Executive dashboards (loss exposure, KRIs), board-ready summaries, audit workpapers

- Workflow: ownership, SLAs, escalations, task automation, Slack/Teams nudges

- Multi-entity, lines of defense (1LoD/2LoD/IA), and segregation of duties

Regulatory coverage (2025)

- SEC cyber disclosure (governance, materiality log)

- EU DORA operational resilience and third-party risk

- EU AI Act (model inventory, impact assessments, transparency)

Commercials

- Named modules, caps (vendors, models, entities), and roadmap access

- Services included (onboarding, integrations, control mapping) vs partner-only

- Exit plan: data export, evidence retention, and re-platforming support

How to Score and Compare Risk Management Vendors (Example Rubric)

| Criterion | Weight | What to Evaluate |

|---|---|---|

| Time-to-value | 25% | Days to live risk register plus mapped controls plus first board report |

| Coverage & accuracy | 20% | Frameworks supported, TPRM depth, evidence quality, CRQ rigor |

| Ease-of-use & adoption | 20% | Risk owners will actually use it (UX, mobile, notifications) |

| Integrations & automation | 20% | How much manual work disappears (API quality, pre-built connectors) |

| Total cost of ownership | 10% | Subscription plus services plus admin effort (3-year view) |

| Vendor viability | 5% | References, roadmap transparency, support SLAs, financial stability |

30/60/90-Day Risk Management Implementation Plan

Day 0-30: Stand-up

Confirm scope (job-to-be-done), import initial risk register, bind owners, integrate IdP/ticketing/cloud. Map top risks to controls and build a single executive dashboard your CEO will actually use. This dashboard becomes your north star for demonstrating value.

Day 31-60: Extend

Turn on continuous monitoring (TPRM ratings feeds, evidence collectors). Run 1st vendor campaign (tiered assessments) or 1st CRQ workshop. Publish operating rhythm (RACI, cadences) and make it a habit, not a project. The goal is embedding risk management into daily operations.

Day 61-90: Prove value

Deliver a board-level view (loss exposure trend, KRI thresholds, treatment status). Close the loop with remediation SLAs and measure cycle times. Lock RACI plus SLAs into workflows and set quarterly risk refresh. This is where you demonstrate ROI and secure ongoing executive support.

Where Comp AI Fits in Your Risk Management Stack

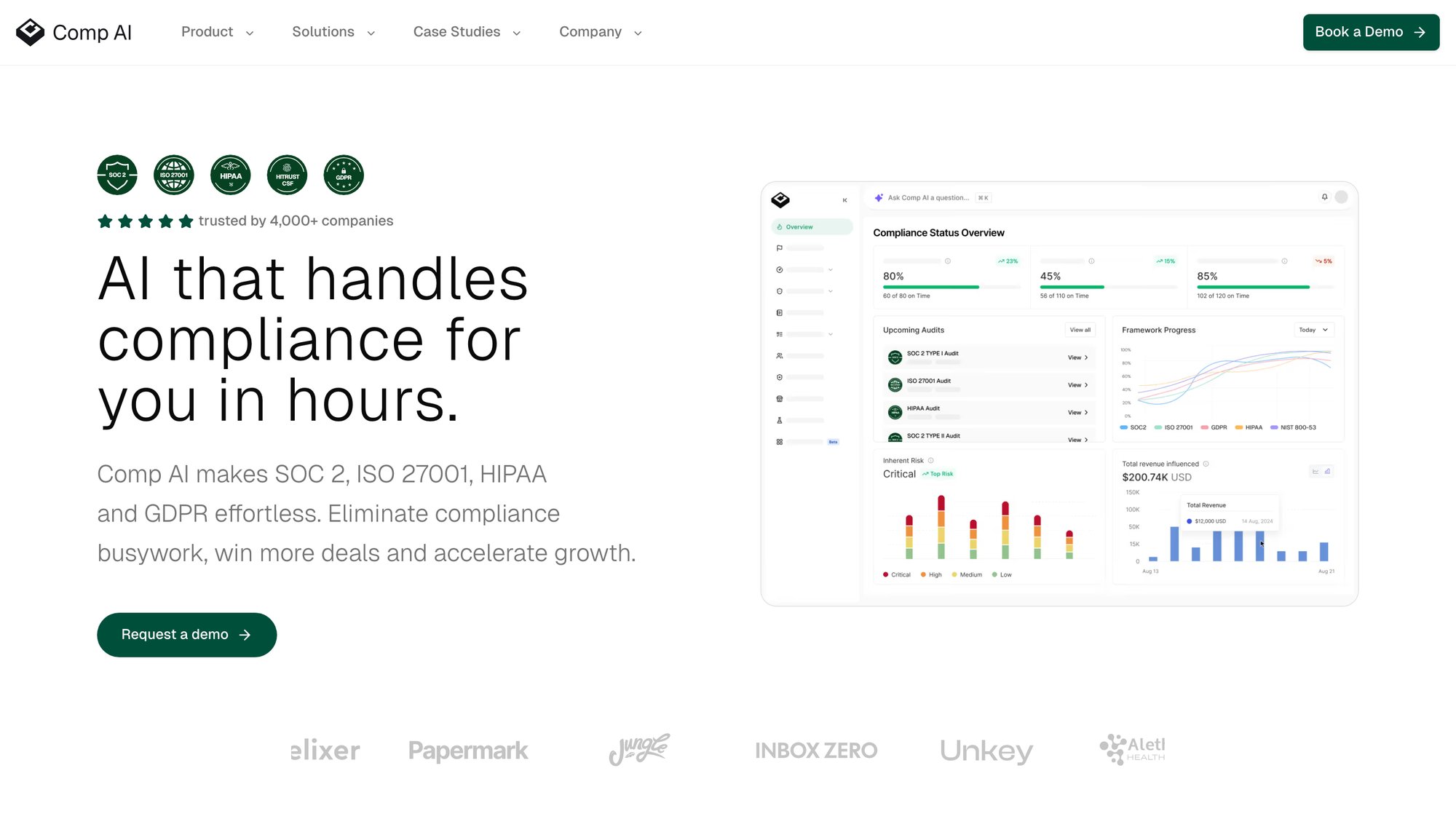

If your immediate goal is to operationalize risk via compliance (for example, SOC 2 / ISO 27001 readiness with a living risk register, mapped controls, automated evidence, and a trust center for customers), Comp AI can reduce lift dramatically while you stand up broader risk processes.

Comp AI's platform delivers what risk teams need most: speed without sacrificing thoroughness. The screenshot above shows the platform's core value proposition—automated compliance that gets you audit-ready in hours, not months, with AI agents handling evidence collection across 100+ integrations while compliance experts provide 1:1 Slack support throughout the process.

Helpful internal resources (practical starting points):

→ Third-Party/Vendor Risk Management Policy (ready-to-adapt template): practical control mapping for risk owners

→ Vulnerability management guides (if your risk reduction hinges on vuln mgmt and patch SLAs)

These assets help you get a risk register and control set into motion quickly, so the rest of your stack (TPRM, CRQ, BCM) has a solid foundation.

What Each Platform Does Best (and Where They Fall Short)

Enterprise suites (OneTrust, ServiceNow, Archer, MetricStream, OpenPages) excel at breadth and governance, but time-to-value varies widely. Partner choice is often more decisive than the platform itself for implementation success.

AuditBoard nails audit plus controls UX. Make sure to evaluate TPRM/BCM depth if those are primary drivers for your organization.

TPRM leaders (ProcessUnity, OneTrust TPRM) and ratings (SecurityScorecard/BitSight) bring market-validated external coverage. Integrations and exchanges are the real differentiators, not just brand recognition.

CRQ tools (RiskLens/SAFE/Axio) translate cyber risk to financial terms that boards understand. Data inputs remain the hard part, so evaluate how the platform will get the loss data and control effectiveness data it needs.

AI governance is no longer optional in 2025. Purpose-built tools (Credo AI) are accelerating, and platform modules are catching up. Align to EU AI Act timelines if you're deploying AI systems.

How to Choose the Right Risk Management Platform for Your Organization

1. Primary driver?

→ Third-party/vendor exposure → TPRM first

→ Board-level cyber/financial risk → CRQ pilot

→ Multi-framework risk governance → Enterprise IRM/GRC

→ Compliance-first momentum → Mid-market GRC (start here, expand later)

→ AI safety/compliance → AI governance now (EU AI Act clock has started)

2. Where's your data already living?

Use platforms you own (ServiceNow, O365/Power BI, privacy tools) to speed adoption. Fighting your existing tech stack creates unnecessary friction and delays time-to-value.

3. Who must use it weekly?

Optimize for the risk owners who must keep the platform updated. Choose the UX they'll actually adopt, not the one that looks best in a vendor demo.

Risk Management Software Comparison: Quick Reference Table

| Vendor | Best For | Notable 2025 Notes | Pricing Notes* |

|---|---|---|---|

| OneTrust (GRC/TPRM) | Integrated privacy + risk + TPRM | IDC 2025 IRM Leader | Quote-based; suite bundles |

| AuditBoard | Audit + controls + risk UX | Strong customer satisfaction | Quote-based; module mix |

| ServiceNow Risk & Compliance | If you're a ServiceNow shop | Powerful workflow/CMDB adjacency | Sub + partner services |

| Archer IRM | Enterprise IRM heritage | Deep governance patterns | Quote-based (module/entity) |

| IBM OpenPages | Financial services & enterprise | AI/Model Risk options | Quote-based; platform |

| MetricStream | Enterprise IRM breadth | BCM/TPRM adjacency | Quote-based |

| LogicGate | Configurable workflows | Mid-market agility | Quote-based |

| ProcessUnity | Questionnaire-heavy TPRM | Exchanges + content | Quote-based |

| SecurityScorecard / BitSight | External ratings | Ecosystem adoption | Portfolio-based |

| RiskLens / SAFE / Axio | CRQ to $$ | FAIR & modern CRQ | Scope + services |

| Credo AI | AI governance / model risk | EU AI Act driver | Quote-based |

| Hyperproof | Mid-market GRC | Public $12k start | Starting at $12k/yr |

| AI-powered compliance automation | 24hr SOC 2 readiness | Most cost-effective |

2025 pricing note: Most enterprise quotes vary by modules, entities, and services. Validate current numbers with the vendor.

5 Common Risk Management Software Selection Mistakes to Avoid

Buying breadth over adoption. A wide suite no one updates is worse than a smaller tool the org uses every week. Measure success by usage, not features purchased.

Ignoring services. Time-to-value is driven by onboarding, integrations, and control mapping. Budget services and internal time realistically, or you'll face delays and frustration.

Over-indexing on heatmaps. Execs want decision-ready insights: loss exposure, trend, top treatments, blockers. Pretty heatmaps don't drive action.

Under-estimating 2025 regs. SEC cyber, DORA, EU AI Act all need concrete evidence flows and accountable owners. Choose platforms that support these frameworks natively.

Risk Management Software FAQ: Your Questions Answered

What is the difference between GRC and IRM software?

GRC (Governance, Risk, and Compliance) and IRM (Integrated Risk Management) are often used interchangeably, but there's a subtle distinction. GRC platforms traditionally focus on compliance management, policy governance, and audit workflows. IRM platforms take a broader view, integrating multiple risk types (operational, financial, strategic, cyber) into a unified framework. In 2025, most vendors offer capabilities that span both GRC and IRM.

The key is understanding your primary use case: if you're compliance-first (SOC 2, ISO 27001), you might lean toward GRC features. If you're managing enterprise-wide risk across business units, IRM capabilities matter more.

How much does risk management software typically cost?

Pricing varies widely based on organization size, modules needed, and vendor. Here's what we're seeing in 2025:

| Segment | Annual Range | Key Drivers |

|---|---|---|

| Mid-market GRC (1-2 frameworks) | $12k-$50k/year | Hyperproof publicly lists "Starting at $12,000/year" |

| Enterprise IRM/GRC suites | $50k-$500k+ annually | ServiceNow often involves subscription plus partner setup costs |

| Specialist TPRM / CRQ | $25k-$200k+ | Driven by portfolio size and data requirements |

Most vendors use quote-based pricing, so negotiate bundles and ask them to price against time-to-value milestones rather than just seat counts.

Can risk management software integrate with existing tools?

Yes, and integration capability is crucial for success. The best platforms in 2025 integrate with:

→ Identity providers (Okta, Azure AD) for user data

→ Cloud platforms (AWS, Google Cloud, Azure) for infrastructure evidence

→ Ticketing systems (Jira, ServiceNow) for remediation tracking

→ Vulnerability scanners and EDR tools for security data

→ HRIS systems (Workday, BambooHR) for employee controls

→ Data platforms and privacy tools for comprehensive coverage

Before selecting a platform, verify it has native integrations or solid APIs for your specific tech stack. The more seamless the integration, the less manual work your team faces.

How long does it take to implement risk management software?

Timeline varies dramatically:

Traditional enterprise platforms (ServiceNow, Archer, MetricStream): 3-12 months for full deployment, including customization, integration, and user training.

Modern mid-market GRC (OneTrust, LogicGate, Hyperproof): 1-3 months for initial deployment, with faster time-to-value through pre-built templates.

Compliance automation platforms (Comp AI for compliance-specific risk): As fast as 24 hours to audit-ready status for frameworks like SOC 2.

The key factor isn't just the software itself; it's your organization's readiness. Having a clear risk taxonomy, control framework, and executive sponsorship dramatically speeds time-to-value.

What's the ROI of risk management software?

ROI comes from several sources:

Time savings: Automating evidence collection and risk assessments can save hundreds of hours per compliance cycle. Calculate this as (hours saved × loaded hourly rate).

Deal velocity: For B2B companies, faster compliance certification means faster enterprise deal closures. Companies report unlocking contracts worth hundreds of thousands in revenue after achieving SOC 2 certification.

Audit cost reduction: Automated evidence collection and continuous monitoring can cut external audit fees by 30-50% by reducing auditor time and audit scope.

Risk reduction: Better visibility into third-party risks, vulnerabilities, and control gaps prevents costly incidents that could run into millions in remediation, legal costs, and reputation damage.

Calculate ROI by estimating: (time saved × loaded hourly rate) + (deals unlocked) + (audit cost reduction) - (software cost + setup).

Do I need different platforms for cyber risk vs operational risk?

It depends on your organization's maturity and complexity. Many enterprises use specialized platforms:

Cyber risk: Dedicated TPRM platforms (SecurityScorecard, BitSight) for external attack surface monitoring, plus GRC platforms for internal cyber controls.

Operational risk: Industry-specific platforms (Riskonnect for manufacturing/safety, banking-specific tools for financial risk).

Strategic/enterprise risk: Broad IRM platforms (OneTrust, ServiceNow, Archer) that span multiple risk domains.

But the trend in 2025 is toward integrated platforms that handle multiple risk domains. Start with your primary pain point, then expand. If compliance is blocking deals, start with a compliance-focused platform like Comp AI, then layer in TPRM or CRQ as your program matures.

How does AI improve risk management software?

AI capabilities in 2025 risk platforms include:

Evidence automation: AI agents automatically collect evidence from cloud platforms, taking screenshots and pulling configs without manual work.

Risk scoring: Machine learning analyzes historical incident data to predict risk likelihood and impact with greater accuracy than static assessments.

Policy generation: AI can draft security policies based on framework requirements and organizational context, reducing weeks of work to hours.

Threat intelligence: Natural language processing scans threat feeds and automatically updates risk registers with emerging threats relevant to your organization.

Questionnaire automation: AI chatbots auto-answer security questionnaires from customers, cutting sales cycle friction and freeing security teams from repetitive work.

Anomaly detection: Pattern recognition identifies control deviations and emerging risks that might escape human notice.

The key is making sure AI augments (not replaces) human judgment. The best platforms maintain human-in-the-loop workflows for critical decisions.

What regulations are driving risk management software adoption in 2025?

Several regulatory drivers are speeding adoption:

EU AI Act: Phasing in from August 2, 2025, requiring model inventories, impact assessments, and governance controls for high-risk AI systems.

DORA (Digital Operational Resilience Act): Effective January 17, 2025 for EU financial services, mandating operational resilience, third-party risk management, and testing.

SEC Cyber Incident Disclosure: Sharpened enforcement in 2025, requiring material incident disclosure within 4 business days and board oversight documentation.

State privacy laws: Expanding US patchwork (California, Virginia, Colorado) driving privacy risk management needs.

Organizations subject to multiple regulations benefit from platforms that map controls across frameworks to avoid duplicative work.

Can small companies afford risk management software?

Absolutely. The market has evolved significantly for smaller organizations:

Transparent pricing: Platforms like Hyperproof start at $12,000/year, making enterprise-grade GRC accessible to mid-market firms without opaque enterprise pricing.

Compliance-first platforms: Comp AI offers packages starting as low as $3,000 with no annual contract, targeting startups and growing companies.

No-code platforms: LogicGate and Onspring let smaller teams configure workflows without expensive consultants or dedicated IT resources.

Fast time-to-value: Modern platforms can be deployed in weeks (not months), cutting setup costs and getting you to value faster.

The key is right-sizing your needs. Don't buy enterprise breadth if you need compliance speed. Start with frameworks that unlock revenue (SOC 2, ISO 27001), then expand your program as budget and maturity grow.

Your Next Step: Choose the Right Risk Platform for Your Needs

There's no universal "top" risk platform. There's a right first platform for your job this quarter. Start where the risk is loudest (vendors, cyber dollar exposure, AI governance, or enterprise governance), win adoption in 90 days, and expand from there.

Want a fast, compliance-driven risk backbone? Comp AI can stand up your risk register, mapped controls, automated evidence, and a live trust portal in days, so you have a working program while your broader IRM stack takes shape. Book a demo to see how.

This guide is based on 2025 data.

Share this article

Help others discover this content